Community Concerns Rise as Hyperliquid Team Confirms Scheduled Unlock

Hyperliquid, the decentralized exchange (DEX) known for its community-driven token model, confirmed the release of 1.75 million HYPE tokens to developers and core contributors on Saturday. The unlock, valued at more than $60 million, prompted immediate debate over whether additional supply could pressure the market.

Team Clarifies Vesting Schedule and Past Token Distribution

The development team emphasized that the release was pre-announced and fully aligned with HYPE’s vesting structure.

A Hyperliquid developer noted that roughly 270 million tokens were already unlocked in November 2024 during what became one of the largest airdrops in crypto history, valued at nearly $9.5 billion at today’s prices.

Hyperliquid’s distribution model stands out for avoiding outside investment.

The project raised no external capital, meaning there are no investor unlocks adding extra selling pressure.

Still, the latest release triggered market unease, with HYPE falling around 4.6% at the time of reporting.

Some analysts argue the token’s decline has been unfolding for months. Arthur Hayes pointed out that even if contributors commit not to sell, the possibility of liquidation remains — and the market has already accounted for that risk.

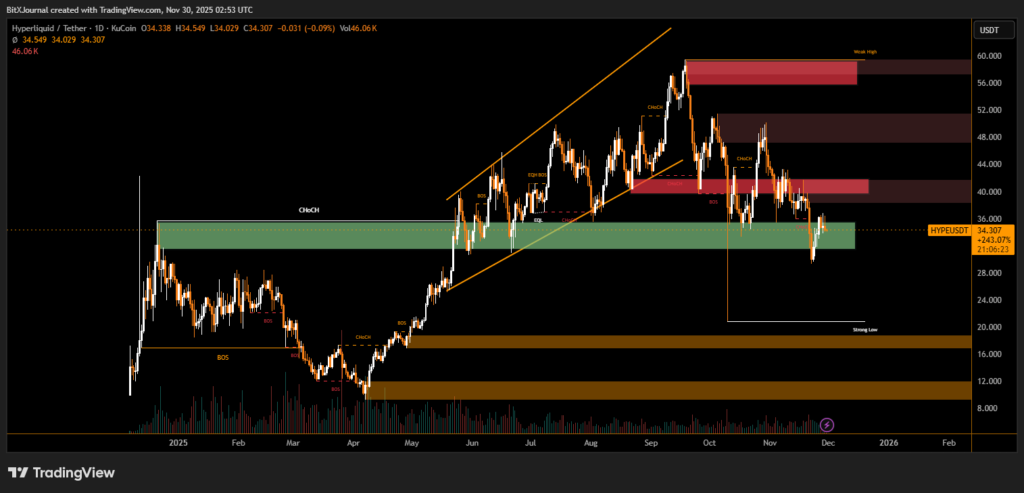

HYPE has dropped about 42% from its all-time high of $59.40, slipping below its 200-day moving average.

The token’s downturn began on September 19, preceding October’s broader market crash in which many altcoins lost up to 95% of their value. HYPE briefly fell 54% on Oct. 10 before rebounding back above $40.

Despite volatility, Hyperliquid continues to earn praise for its performance. Analysts highlight the platform’s ability to process $330 billion in monthly trading volume, achieved with a notably small development team — a factor contributing to its reputation as one of the most efficient DEX architectures in the ecosystem.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.