Analyst sees liquidation event as a key buying opportunity as ETFs and rate cuts drive next rally

Despite a record $19 billion crypto market crash, Standard Chartered’s head of digital assets research Geoff Kendrick believes Bitcoin (BTC) is poised to reach $200,000 by year-end — calling the recent turmoil a “buying opportunity” for long-term investors.\

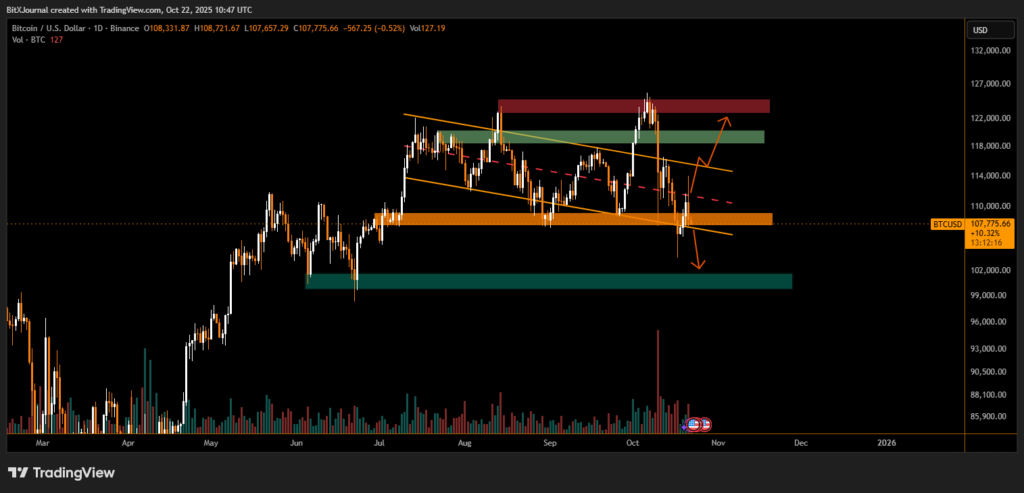

The massive liquidation event on October 10 sent Bitcoin plunging to $104,000, its lowest level in four months. Yet, as markets begin to stabilize, Kendrick says the pullback could serve as the foundation for the next major rally.

“My official forecast is $200,000 by the end of the year,” Kendrick told an audience at the 2025 European Blockchain Convention in Barcelona, adding that even in a conservative scenario, prices could remain well above $150,000 if the Federal Reserve continues cutting interest rates as expected.

According to Kendrick, the correction may take “several weeks” to fully unwind, but the dip is already being viewed as an accumulation phase. He believes traders will recognize the event as one of the last chances to enter before Bitcoin’s next bullish breakout.

The optimism stems from strong inflows into Bitcoin exchange-traded funds (ETFs), which Kendrick called the “primary catalyst” for continued upside.

“The current dip prepares us for another leg up, mostly on the back of ETF inflows,” he explained. “There’s no reason for them to stop. The U.S. government’s shutdown, Fed rate cuts — all that story is already playing out in gold.”

Recent data supports his outlook. Bitcoin ETFs recorded $477 million in net inflows on Tuesday, breaking a four-day streak of outflows and signaling renewed institutional demand.

At the same time, gold’s record highs are bolstering Bitcoin’s safe-haven narrative, helping investors see it as a hedge against inflation and economic uncertainty.

Kendrick also reaffirmed his long-term projection of Bitcoin reaching $500,000 by 2028, suggesting that macro tailwinds, ETF demand, and institutional adoption will continue to drive exponential growth.

Bitcoin ETF inflows, USD, million. Source: Farside Investors

“This sell-off might be the last big shakeout before Bitcoin’s next major run,” Kendrick said. “Smart money is already positioning for what’s next.”

As volatility fades, analysts say the post-crash environment could define the next phase of Bitcoin’s long-term bull cycle — one built not on hype, but on sustained institutional participation and maturing market fundamentals.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.