Standard Chartered, a major global bank, has renewed its bold prediction that Bitcoin could hit $500,000 in the long term, citing a growing trend of sovereign-level indirect exposure to Bitcoin—primarily through investments in MicroStrategy (MSTR).

“Nation-states may already be gaining Bitcoin exposure indirectly,” said Standard Chartered, as MicroStrategy’s BTC-focused stock becomes a vehicle for sovereign wealth funds and institutions.

MicroStrategy: A Proxy for Institutional and Sovereign Bitcoin Exposure

MicroStrategy (MSTR), led by executive chairman Michael Saylor, holds over 214,000 BTC and has become a de facto Bitcoin ETF alternative for investors in jurisdictions where direct crypto exposure is limited or banned.

Standard Chartered believes that “sovereign wealth funds and central banks” may be increasing their Bitcoin positions quietly—via MSTR stock.

“Buying MSTR is a strategic way to gain BTC exposure without holding the asset directly,” the bank stated.

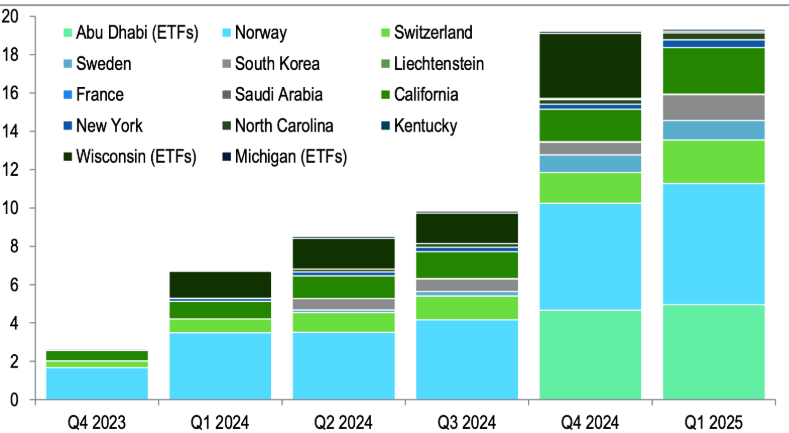

Government Holdings of BTC ETFs and MSTR*

Why Sovereign Interest in Bitcoin Is Rising

There are several key reasons behind the growing interest from sovereign entities:

- Rising inflation and fiat currency devaluation

- Geopolitical uncertainty and monetary diversification

- Bitcoin’s long-term store-of-value appeal

- Lack of crypto regulatory clarity in many regions

Indirect investment via stocks like MSTR offers a “regulatory grey zone” for states wanting crypto exposure without triggering compliance hurdles.

Backing the $500,000 Bitcoin Price Prediction

Standard Chartered had previously predicted a $100,000 BTC price by end of 2024, and now reaffirms its long-term projection of $500,000, contingent on:

- Mass institutional and sovereign adoption

- ETF market maturity

- A halving-driven supply shock (next expected in 2028)

“If sovereign demand scales, Bitcoin can realistically achieve half-a-million dollars per coin,” said the bank’s analysts.

MicroStrategy’s Growing Influence

As of 2025, MicroStrategy’s stock performance has often outpaced Bitcoin itself, thanks to leveraged BTC buys and consistent accumulation.

MSTR has effectively become the gateway for institutional and sovereign Bitcoin exposure—especially in regulated financial markets.

Conclusion

Standard Chartered’s analysis highlights an emerging trend in global finance: the quiet, indirect accumulation of Bitcoin by sovereign entities via MicroStrategy.

As these entities seek store-of-value assets amid economic uncertainty, this strategy could significantly accelerate Bitcoin adoption and price growth.

The bank’s reaffirmation of a $500,000 BTC target signals growing confidence in Bitcoin’s long-term role in the global monetary system.