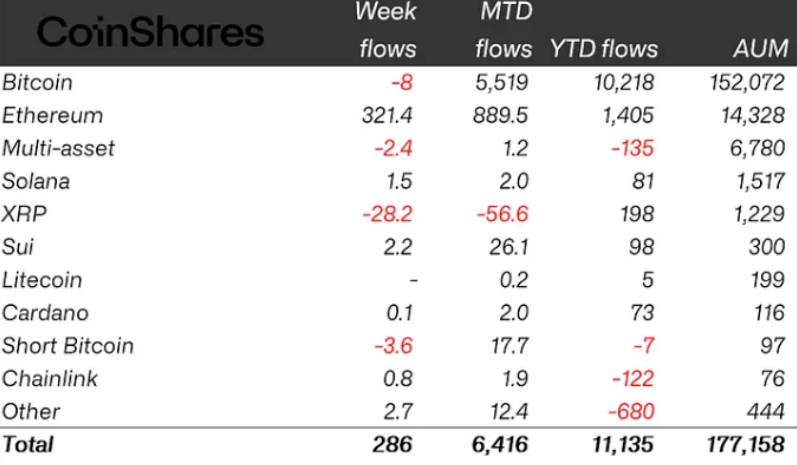

Cryptocurrency investment products continued their positive momentum, recording $286 million in inflows last week, even as Bitcoin prices fell sharply. The data, published by CoinShares on June 2, highlights a growing investor preference for Ether-based products amid rising market volatility.

Crypto ETPs Maintain Strong Inflow Streak

Digital asset exchange-traded products (ETPs) have now posted seven consecutive weeks of inflows, totaling over $10.9 billion.

These figures reflect sustained institutional interest in crypto assets, despite price pressures. The week ending May 30 saw continued inflows even as Bitcoin dropped by over 6%, from $110,000 to a low of $103,400, according to CoinGecko.

However, CoinShares’ report also noted that total assets under management (AuM) dropped from $187 billion to $177 billion, due to overall market drawdowns driven by uncertainty around US tariff policies.

Ether Investment Products Dominate Inflows

Ether (ETH) ETPs attracted $321 million in inflows, the strongest performance since December 2024.

This surge in capital allocation indicates a notable improvement in market sentiment toward Ethereum. Investors may be anticipating developments around ETH staking, scalability upgrades, or broader adoption of the Ethereum network.

Ether outperformed all other crypto assets last week in terms of ETP investment flows.

Bitcoin and XRP Face Outflows

In contrast, Bitcoin investment products saw $8 million in outflows, marking a reversal from previous weeks. According to CoinShares, the shift came after a New York Court decision declaring US tariffs illegal, leading to short-term uncertainty in macroeconomic markets.

Bitcoin’s market volatility led to modest investor pullback, despite strong long-term fundamentals.

Meanwhile, XRP products experienced the largest outflows, totaling $28 million, making it the second consecutive week of losses for XRP-focused investment vehicles.

XRP faced the steepest investor retreat among major altcoins, reflecting weakening investor sentiment.

Conclusion: Institutional Crypto Interest Remains Strong

Despite Bitcoin’s price correction and regulatory noise, the inflow data suggests that institutional appetite for crypto remains intact. The shift toward Ether ETPs may indicate a diversification strategy as investors seek exposure beyond Bitcoin.

With seven straight weeks of inflows, the crypto ETP market is showing signs of resilience amid macroeconomic headwinds.