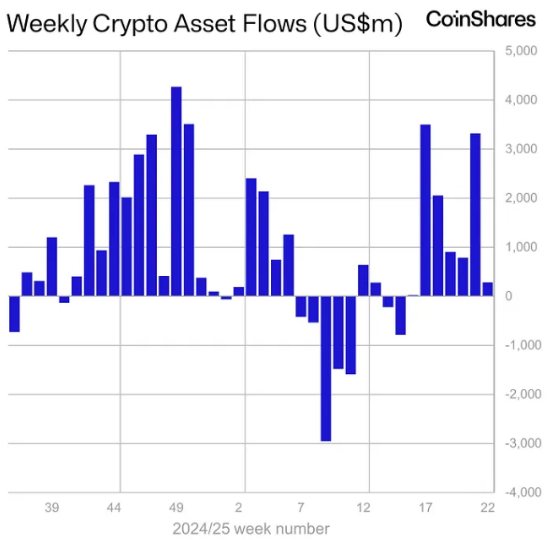

Global interest in cryptocurrency investment products surged last week, with net inflows reaching $286 million, according to recent asset management data. This marked the seventh consecutive week of positive inflows, reflecting growing institutional demand despite price volatility and macroeconomic uncertainty.

Ethereum Investment Products Dominate

Ethereum-based funds led the charge, drawing in $321 million in net inflows over the past week. This represents Ethereum’s strongest run since December 2024, with total inflows now reaching $1.2 billion over six weeks.

U.S.-listed spot Ethereum exchange-traded funds (ETFs) accounted for $285.8 million of these inflows, signaling renewed investor confidence in Ethereum’s long-term potential.

Ethereum’s dominance in fund inflows marks a significant shift in sentiment, especially as Bitcoin investment products began to lose steam.

Bitcoin ETF Inflows Cool Off

Despite leading the crypto fund landscape for months, Bitcoin-based investment products saw net outflows of $8 million last week. This ended a 34-day inflow streak driven by major players in the ETF space.

The pullback followed a U.S. court ruling that declared certain tariffs illegal, which contributed to increased market volatility and reduced investor appetite for risk assets like Bitcoin.

Over six weeks, Bitcoin products had attracted more than $9.6 billion, indicating the current pause could be temporary amid larger structural bullish trends.

Global Shift in Crypto Investment Trends

Regionally, the United States remained the largest contributor to crypto fund inflows, with $199 million last week. However, interest is expanding internationally:

- Hong Kong posted $54.8 million in net inflows — its best since launching ETFs in April 2024

- Germany and Australia recorded $42.9 million and $21.5 million, respectively

- Switzerland saw net outflows of $32.8 million, reflecting a regional shift in capital flow

Market Outlook

Despite the inflows, total crypto assets under management declined from $187 billion to $177 billion due to price corrections. Over the week, Ethereum fell by 2.7% to $2,488, and Bitcoin dropped by 4%, reflecting the impact of tariff concerns and delayed monetary easing.

The rise in Ethereum inflows, even as prices correct, suggests growing investor conviction in the asset’s long-term utility and ecosystem growth.

With the crypto market facing evolving global regulations and macroeconomic shifts, Ethereum’s recent momentum signals a potential change in leadership among digital assets.