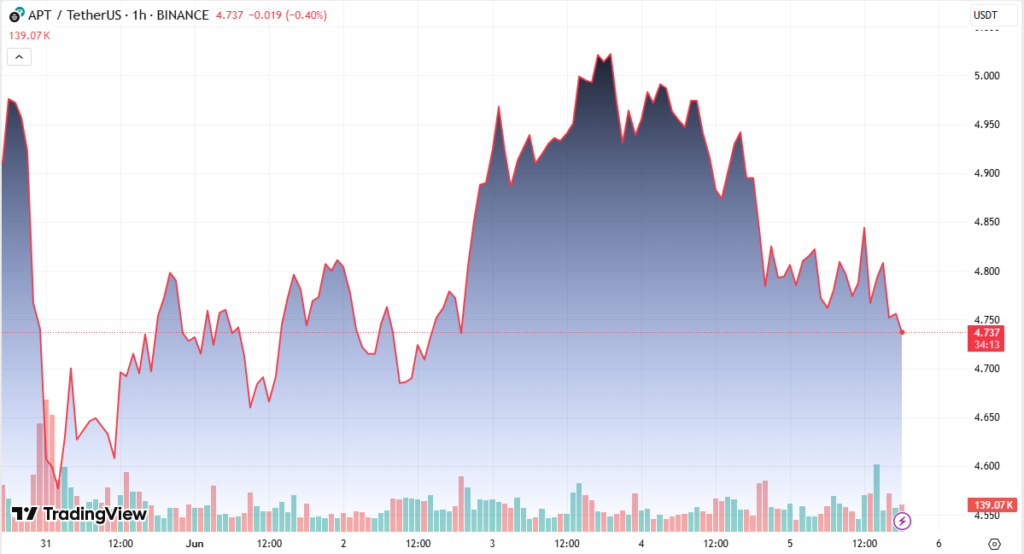

Aptos (APT) witnessed a 4% intraday decline, falling through a critical technical support level of $4.77 before stabilizing. The move came as geopolitical tensions and broader market volatility weighed on investor sentiment, contributing to bearish pressure across digital assets.

APT Trades in Narrow Range After Breakdown

APT traded within a 3.6% range, fluctuating between an intraday high of $4.945 and a low of $4.751. This volatility established a resistance band between $4.83 and $4.86, where price faced multiple rejections.

The token has since rebounded modestly and is now consolidating near $4.771, reclaiming nearly half of its earlier losses. The recovery comes as market participants assess whether recent declines represent a temporary pullback or signal a deeper correction.

High Volume Confirms Key Support at $4.77

A spike in trading activity confirmed the $4.77 level as a volume-supported support zone. During the selloff, over 1.25 million APT tokens were traded, with particularly intense activity noted between 13:45 and 13:54, where more than 30,000 units per minute changed hands.

This surge in volume reflects heightened interest at lower levels, where buyers attempted to absorb downward momentum and establish a short-term floor.

Price Action Forms Descending Channel

APT’s short-term price action has formed a descending channel, with the latest dip seeing the price fall 2.1% from $4.864 to $4.762. This pattern highlights continued selling pressure, though the stabilization around $4.771 could indicate a potential consolidation phase before a reversal or further decline.

Repeated testing of resistance levels and minor recoveries suggest buyers are re-entering cautiously, awaiting confirmation of a trend reversal.

Outlook: Consolidation or Further Downside?

The Aptos token’s ability to hold above $4.77 will be key in determining its next move. If support at $4.77 fails to hold, APT could retest lower levels near $4.65. Conversely, a sustained push above $4.83 would be needed to shift momentum back in favor of the bulls.

At the time of writing, the CD20 index — tracking major crypto assets — was down over 2%, reinforcing the cautious tone across digital markets.

APT’s current consolidation hints at indecision, with traders watching closely for the next breakout or breakdown signal.