Jack Ma-Backed Fintech Giant Pushes Into Regulated Crypto Payments

Ant International, the Singapore-based arm of Ant Group, is reportedly preparing to apply for stablecoin licenses in Hong Kong and Singapore. This move reflects growing interest from traditional fintech players in the evolving regulatory landscape surrounding crypto payments.

Ant Group is affiliated with Alibaba and operates Alipay, the world’s largest digital payment platform serving over 1.3 billion users and 80 million merchants globally.

According to sources, Ant International plans to submit its license application in Hong Kong as soon as the Stablecoin Ordinance bill takes effect on August 1, 2025. The company also aims to pursue stablecoin-related regulatory approvals in Singapore and Luxembourg.

Regulatory Clarity Encourages Institutional Adoption

The new Hong Kong licensing regime will require stablecoin issuers to obtain approval from the Hong Kong Monetary Authority (HKMA). Violations could result in penalties of up to HK$5 million (approx. $640,000). This framework is part of a broader effort to bring compliance and transparency to the fast-growing stablecoin sector.

The move signals rising institutional confidence in regulated digital asset infrastructure as a foundation for future fintech innovation.

Stablecoins to Power Cross-Border Payments and Treasury Operations

Ant International intends to use stablecoins to enhance its cross-border payments and treasury management capabilities. In 2024, nearly one-third of the firm’s $1 trillion global transaction volume was processed through its blockchain-based Whale platform, according to insiders.

The firm is also responsible for handling transactions related to Alibaba’s e-commerce operations, reinforcing its critical role in global digital commerce.

Ant Group has long demonstrated an interest in blockchain. In late 2024, it partnered with the Sui blockchain to tokenize ESG-linked real-world assets.

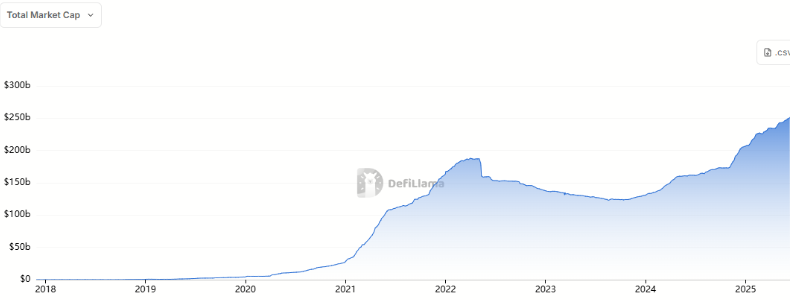

Global Stablecoin Growth Could Be 2025’s Key Crypto Catalyst

This development comes as the global stablecoin market capitalization recently exceeded $250 billion for the first time, according to DefiLlama. Analysts suggest the total supply could top $1 trillion by the end of 2025, positioning stablecoins as the next major growth catalyst for the crypto industry.