NEAR Protocol is under increased selling pressure, with the token falling sharply even as the network reaches record adoption metrics. The contrast between growing on-chain activity and declining token value has sparked debate around NEAR’s long-term tokenomics and inflation structure.

Token Plunges Amid Heightened Volatility

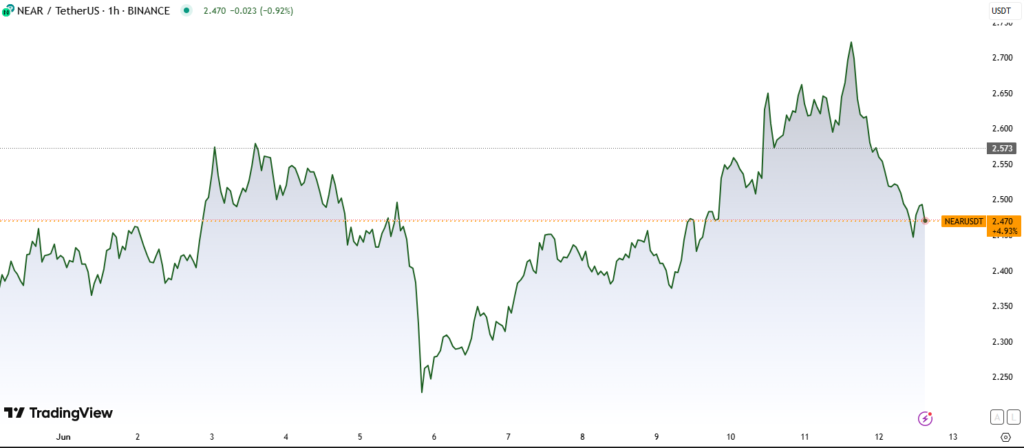

NEAR dropped 8.6%, falling from $2.696 to $2.492 within 24 hours.

The decline was accompanied by high-volume sell-offs, notably at 17:00 on June 11 and 08:00 on June 12, triggering sharp breakdowns in price structure. The token is now trading below its resistance level at $2.730, with a new support zone forming around $2.445.

Massive Growth in User Adoption

Despite its market performance, NEAR Protocol recorded 46 million monthly active users in May 2025, making it the second most used layer-1 blockchain, surpassing Ethereum, Binance Chain, and Tron — and only trailing Solana.

This signals growing developer and user confidence in the ecosystem, which has benefitted from a surge in app launches and on-chain utility.

DWF Labs Calls for Inflation Reform

Investment firm DWF Labs recently issued a proposal urging NEAR to cut its token inflation rate from 5% to 2.5%. To incentivize this change, the firm pledged to purchase 10 million NEAR tokens if the reduction is implemented.

Concerns about inflation and token dilution have been cited as reasons for market hesitation, despite network growth.

Technical Outlook: Bearish Momentum Continues

- Clear resistance at $2.730 continues to cap recovery attempts.

- Support formed at $2.445 during high-volume bounces.

- Short-term ascending channel identified with boundaries at $2.481 (support) and $2.495 (resistance).

- Hourly chart shows a 0.7% recovery from a low of $2.476, with buying spikes at 13:38, 13:54, and 14:01.

While consolidation is underway, the token remains in a broader downtrend and will require a strong catalyst — such as inflation reform — to reverse sentiment.