The proposed Big Beautiful Bill under President Trump could add over $2.4 trillion to the U.S. national debt, potentially triggering a financial crisis and a surge in Bitcoin demand. The bill’s passage may mark a turning point for the dollar and highlight the urgency of self-custodied digital assets.

A Ballooning Deficit with Trillion-Dollar Risks

According to government budget forecasts, the Big Beautiful Bill would reduce federal revenue by $3.67 trillion while only cutting $1.25 trillion in spending. That’s a net increase of $2.4 trillion in debt, with actual costs possibly reaching $5 trillion if temporary tax cuts are made permanent.

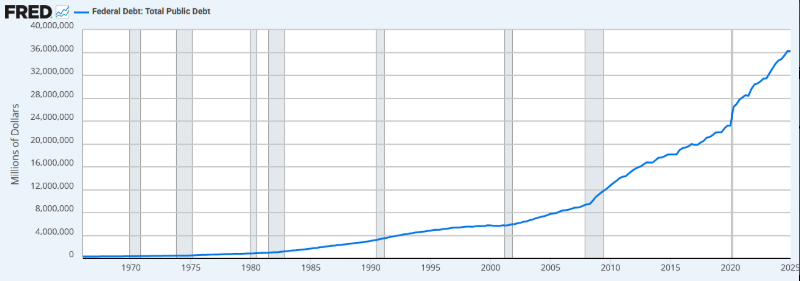

The U.S. debt stands at nearly $37 trillion, and annual deficits are projected to stay above 7% of GDP.

Meanwhile, real GDP growth remains tepid, making it impossible for the U.S. to “grow its way out” of the crisis without either tax hikes or drastic spending cuts—both politically unlikely.

Inflation and Devaluation Are the Easiest Options

As outlined by Ray Dalio in his research on debt cycles, governments typically resort to currency devaluation and inflation when deficits become unsustainable. Printing money becomes a politically easy solution, though it silently erodes the value of cash, bonds, and savings.

Devaluation often happens abruptly during debt crises — and the U.S. appears to be approaching that moment.

Bitcoin: A Hedge Against Monetary Repression

As inflation takes hold and real interest rates turn negative, Bitcoin emerges as a key monetary hedge. Its fixed supply and decentralized nature make it resistant to inflationary policies.

However, not all Bitcoin exposure is created equal. In times of crisis, custodial services and ETFs may face redemption freezes or collapse.

Only self-custodied Bitcoin — held in cold wallets with private keys — offers true protection from financial instability.

Conclusion

If passed, the Big Beautiful Bill could mark the beginning of a new debt spiral, pushing the U.S. closer to fiscal repression and the dollar toward devaluation. In such an environment, Bitcoin held in self-custody could be the last reliable refuge for preserving wealth.