Leveraged BTC Strategies May Destabilize the Crypto Market

Coinbase has issued a strong warning about potential systemic risks stemming from public companies using debt to accumulate Bitcoin. In its June market outlook, the exchange revealed that while over 228 public firms collectively hold 820,000 BTC, only about 20 companies are pursuing high-risk leveraged strategies that could have market-wide consequences.

These strategies often involve issuing convertible notes or debt to finance large-scale Bitcoin acquisitions. According to Coinbase, this leaves firms vulnerable to forced liquidations if refinancing becomes difficult, especially during periods of market stress or rising interest rates.

“Even a relatively small unexpected sale by one of these entities could destabilize investor confidence and lead to a broader liquidation event,” the report cautions.

Key Risks: Forced and Discretionary Selling

Coinbase outlines two primary risks associated with what it calls Publicly Traded Crypto Vehicles (PTCVs):

- Forced Selling:

If companies cannot refinance maturing debt—some of which may be callable as early as 2026—they may have no choice but to offload Bitcoin holdings, potentially triggering a sharp market sell-off. - Discretionary Selling:

Even without debt pressure, firms might choose to liquidate BTC to fund operations. Given their significant holdings, any discretionary sale could negatively impact market sentiment, leading to a cascade of exits from other players.

Macroeconomic Factors Add Complexity

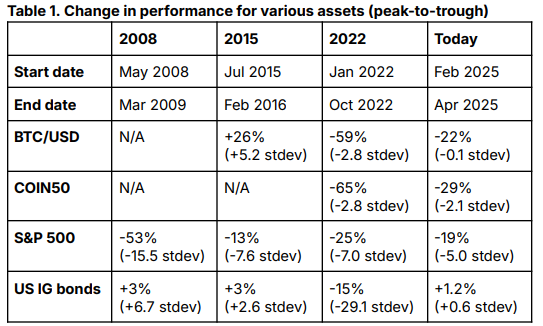

The report also links macro conditions to crypto market volatility. Although U.S. economic data shows strong resilience—GDPNow estimates rising to 3.8% as of June 5—long-term Treasury yields hit a 20-year high (5.15%), which could raise borrowing costs for debt-heavy crypto firms.

“If long-dated yields continue rising, financial tightening may stifle PTCV growth and elevate systemic risk in crypto markets,” Coinbase warned.

Looking Ahead: Stability vs. Structural Risk

Despite concerns, Coinbase sees broader market strength and regulatory clarity in the U.S. as supportive elements for crypto. However, the growing use of corporate debt to buy Bitcoin introduces new structural vulnerabilities.

As leveraged crypto strategies grow, the risk of sharp corrections driven by a few corporate actions cannot be ignored.