Uniswap Retraces Gains After Overnight Flash Crash Recovery

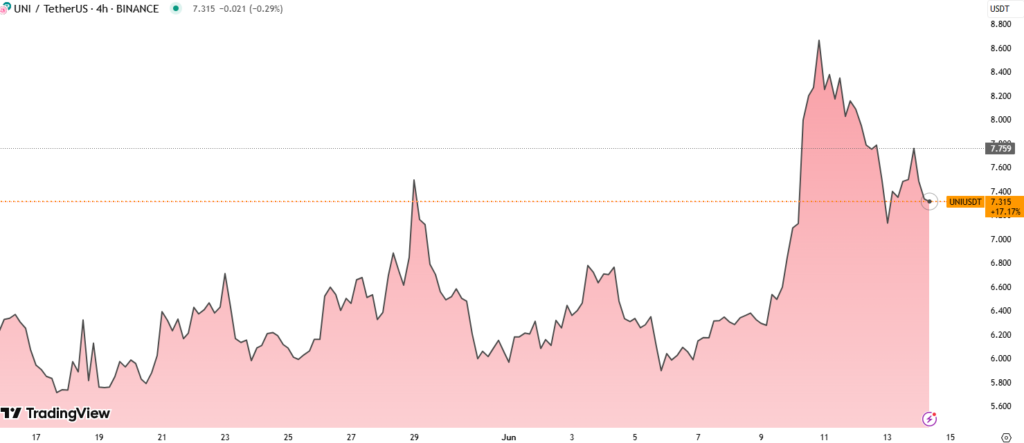

Uniswap’s UNI token fell 6.36% to $7.3864 in the last 24 hours, reversing an early morning rally triggered by a V-shaped recovery from $6.82. The sharp drop and rebound were followed by renewed weakness as global markets responded to intensifying Middle East tensions.

UNI surged 9.5% off the lows, reaching as high as $8.40 before retreating.

Trump’s Warning Spurs Risk-Off Sentiment

In a Friday morning statement, former President Donald Trump warned of “more brutal” actions against Iran, pushing investors away from risk assets. He said Iran would face “death and destruction” if it refused to reach an agreement, escalating fears of regional conflict.

Crypto markets, including UNI, reacted swiftly, as traders weighed the risks of a broader escalation.

This geopolitical shift comes at a time when crypto sentiment was already fragile. Although UNI showed strong short-term recovery, risk appetite faded as tensions in the Middle East pushed investors toward safer assets.

Technical Breakdown: V-Reversal to Consolidation

- UNI dropped from $7.90 to $6.82, a 12.5% plunge on high volume (8.48M).

- A quick V-shaped reversal followed, lifting price back above $8.40 before losing steam.

- Volume peaked between 13:31–13:44 UTC, signaling buyer interest during the rebound.

- UNI is now consolidating near $7.38, with support at $7.26 tested multiple times.

- Immediate resistance sits at $7.50, and failure to break above may trigger further downside.

Support near $7.26 has held so far, but pressure is building amid fading bullish momentum.

Market Outlook: Caution Amid Global Uncertainty

UNI’s latest price action underscores how macro headlines can overwhelm technical setups. While the protocol remains strong on fundamentals, token price is currently at the mercy of external volatility, not internal development.

With no clear resolution to geopolitical threats in sight, traders may continue to favor defensive positions, keeping UNI pinned below key resistance zones in the short term.

UNI’s early rebound fizzled as geopolitical risk returned. With price hovering near $7.38 and key support at $7.26, bulls need a strong macro tailwind to regain momentum.