SOL Price Drops Nearly 8% Amid Market Turbulence

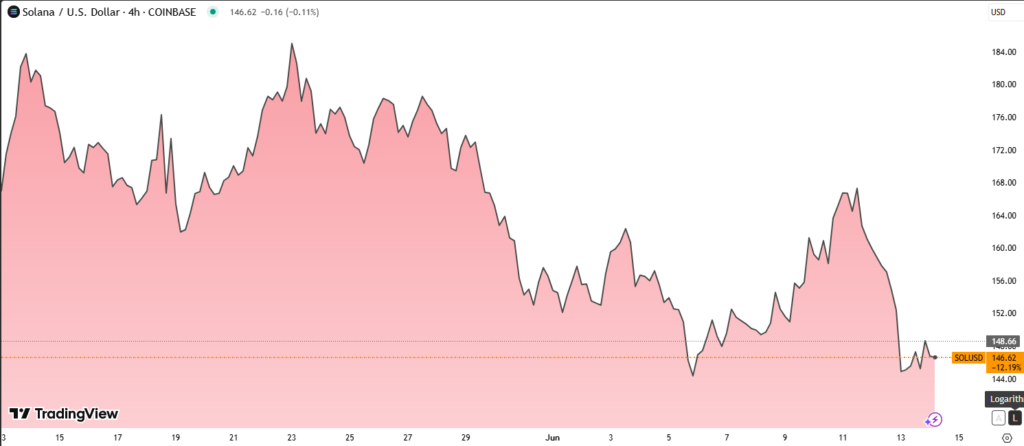

Solana’s SOL token fell 7.87% to $147.07, despite long-term bullish sentiment from institutional analysts. The price hit an intraday low of $142.13 during early Friday trading, reflecting a sharp correction from Thursday’s high of $159.60.

Buyers defended the $143–$144 zone, forming a narrow consolidation range between $143.50 and $146.50.

Trading volume spiked during the 13:30 UTC window, as bulls stepped in to prevent further downside, although resistance near $150 remains firm.

Standard Chartered Expects SOL to Reach $275 in 2025

On May 27, global analysts published a formal price target of $275 for SOL by the end of 2025, nearly a 90% upside from current levels. Their long-term projection reaches as high as $500 by 2029, citing Solana’s transaction speed, efficiency, and scalability as key drivers.

However, current market sentiment diverges sharply from that optimism.

This gap between short-term weakness and long-term expectations raises questions for investors about the nature of recent pullbacks.

Standard Chartered also noted that Solana’s growth narrative remains clouded by its recent meme-coin-driven activity, which is yet to translate into sustainable on-chain adoption.

Technical Outlook: Support Holding, But Upside Limited

Solana saw an 11.87% intraday drop, from $160.49 to $142.13. However, buyers quickly entered around $143, creating a series of higher lows suggesting early signs of a bullish divergence.

Volume peaked at 13:31 and 13:39 UTC, with 31.8K and 43.4K SOL traded, as accumulation near support zones intensified.

Currently, SOL faces key resistance at $152. A confirmed breakout above this level could reverse the short-term trend, while a drop below $143 would expose the token to deeper losses.

Investor Sentiment: High Beta, High Risk

SOL remains a high-beta asset tied closely to retail speculation and broader crypto market momentum. Analysts believe its success hinges on the expansion of real-world use cases and sustained on-chain activity beyond memecoins.

Whether SOL can deliver on bullish year-end targets may depend on macro recovery, improved risk appetite, and institutional interest in blockchain scalability.