ADA Slips on Governance Uncertainty

Cardano’s native token ADA fell 6.01% to $0.6412, reacting to market volatility and an internal debate over a proposed $100 million stablecoin liquidity injection. The move comes as the Cardano community evaluates a proposal to deploy 140 million ADA from the treasury to boost liquidity for native stablecoins like USDM.

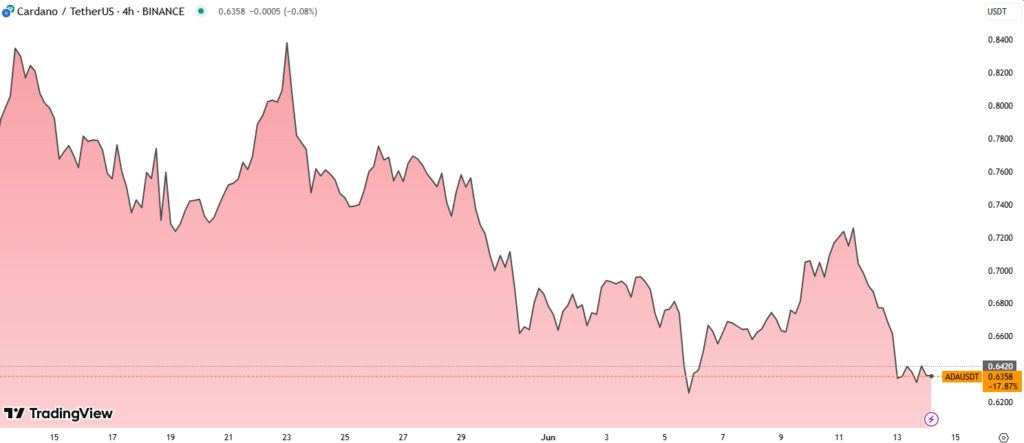

ADA tested a low of $0.625 before rebounding modestly, facing resistance at $0.645.

Divided Views on Treasury Allocation

The proposal sparked strong opinions from both supporters and critics. Charles Hoskinson, Cardano founder, defended the plan, stating that the conversion could be executed gradually using over-the-counter (OTC) trades and algorithmic tools like TWAP (Time-Weighted Average Price), to avoid sudden market disruption.

“This is a false narrative. Sell pressure can be minimized,” Hoskinson said, pushing back against market manipulation concerns.

On the other hand, prominent community voices raised red flags. One influencer warned that any public plan to sell ADA around $0.70 could be front-run by traders, leading to real sales happening much lower — potentially near $0.50. Instead, they proposed the minting of crypto-backed stablecoins like ObyUSD as a non-dilutive alternative.

Technical Analysis: Key Levels in Focus

- ADA dropped from $0.688 to $0.625 before recovering to $0.641.

- Support was confirmed near $0.622, following a surge in volume during the 01:00–02:00 UTC window.

- A rising channel formed, indicating possible mild accumulation, but resistance remains firm at $0.645.

- Volume spikes at 13:50 and 14:00 UTC (2.6M and 5.7M ADA) reflect buying interest but not enough to trigger a breakout.

Buyers are stepping in near $0.636, but price remains vulnerable.

DeFi Expansion vs. Market Timing

This proposal has become a litmus test for Cardano’s approach to balancing long-term ecosystem growth with short-term token economics. Supporters argue it is a bold step to finally establish strong DeFi foundations, while critics worry about timing and execution transparency.

With ADA unable to sustain a breakout above $0.68, the debate highlights deeper challenges around governance, tokenomics, and how Cardano positions itself in a rapidly evolving decentralized finance landscape.

Summary

ADA’s 6% drop follows a controversial $100M liquidity proposal. As the Cardano community debates its DeFi strategy, all eyes are on how treasury assets are managed under current market pressure.