The “Satoshi Ally” Vows to Catch Bitcoin If It Ever Falls

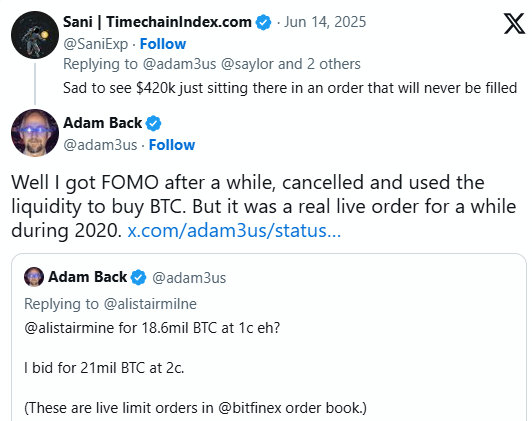

Adam Back, cryptography pioneer and CEO of Blockstream, has made headlines again—this time for placing a limit order to buy all available Bitcoin (BTC) at $0.02, in a symbolic move to prevent Bitcoin from ever crashing to zero.

Back, who is notably referenced in Satoshi Nakamoto’s original Bitcoin whitepaper, said the gesture is part of a personal mission to ensure Bitcoin’s resilience, even under the most extreme circumstances.

“If Bitcoin ever crashes to $0.02, I’ll buy it all,” he stated, echoing a sentiment that has sparked conversation across the crypto community.

Why It’s Symbolic—And Practically Impossible

While the offer made headlines, it’s not technically feasible. Roughly 19 million BTC have already been mined, and 2 million remain locked in yet-to-be-mined blocks. Moreover, most of the circulating BTC is held in cold storage, institutional ETFs, and corporate treasuries, including Michael Saylor’s MicroStrategy, which alone holds 582,000 BTC—worth over $61 billion.

Simply put, even if Bitcoin’s price momentarily tanked, liquidity constraints and custodial lockups would prevent anyone from buying “all” BTC.

Saylor Predicts Bitcoin’s Moonshot

Back’s comments followed a bold Bitcoin price prediction from Michael Saylor, who tweeted:

“If it’s not going to zero, it’s going to a million.”

Saylor’s hyper-bullish forecast came after Bitcoin experienced a sharp 4.33% drop, falling from $108,000 to $103,000, before rebounding to trade above $105,000.

With the rise of spot Bitcoin ETFs—led by BlackRock, Fidelity, Bitwise, and Grayscale—massive institutional inflows are steadily removing BTC from exchange supply, a key driver behind Saylor’s long-term bullishness.

Why Back’s Statement Still Matters

While Adam Back’s $0.02 bid may be symbolic, it reflects a deep-rooted confidence in Bitcoin’s future. It also sends a psychological message: there will always be buyers—especially true believers—willing to step in if panic strikes.

With Bitcoin gaining momentum and institutional demand surging, analysts argue that the chances of BTC “going to zero” are practically non-existent. Instead, the long-term narrative continues to lean toward hyperbitcoinization—or at the very least, massive appreciation.