BTC Defends $105K Support as Market Eyes Geopolitical Risks

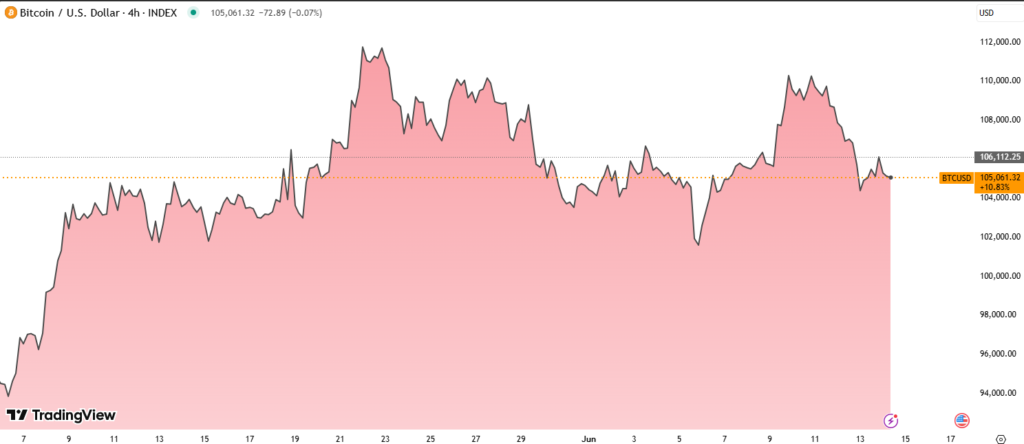

Bitcoin remained resilient on June 14, trading at $105,101, down just 0.22% over 24 hours, despite growing concerns surrounding the Israel-Iran conflict and escalating global trade tensions. The asset briefly dipped to $104,182 overnight, sparking volatility in the Asia trading session, before rebounding with strong buying momentum.

Over 15,000 BTC were traded during the recovery, indicating aggressive dip buying activity around key support levels.

Geopolitical Uncertainty Weighs on Risk Markets

The ongoing Israel-Iran war and renewed U.S. tariff concerns, tied to election-year politics, have pressured risk assets globally. The crypto market saw over $1.1 billion in liquidations earlier this week, though Bitcoin has largely maintained its bullish structure.

Despite the headlines, BTC continues to print higher lows, a sign that longer-term buyers are supporting price during intraday weakness. The $105,000 level remains a critical psychological and technical support zone, while upside gains are facing resistance near $106,200 due to consistent profit-taking.

Key Technical Levels and Market Sentiment

- Price Range (Past 24H): $104,182 – $106,272

- Support: Firm buying was seen at $104,182, with multiple tests around $104,950 – $105,000 holding strong.

- Resistance: Sellers are active near $106,200, keeping a lid on any sharp breakout.

- Trend Structure: Rising trendline of higher lows remains intact, favoring bullish continuation.

- Volume Analysis: Accumulation on dips suggests institutional or large-wallet support.

Market Outlook: Consolidation, Not Reversal

While volatility remains elevated due to macro uncertainties, Bitcoin is consolidating rather than reversing. As long as $104,950–$105,000 holds, traders expect another attempt toward $106,200 or higher. However, a decisive break below $104,000 could open the door to deeper retracements.

Summary: Resilient Price Action Reflects Growing Maturity

Bitcoin’s ability to absorb global macro stress and hold key support zones signals market maturity. Investors are watching the $105K zone as a battle line between bulls and bears, with volume patterns indicating quiet accumulation. If risk sentiment stabilizes, BTC may resume its climb, potentially retesting recent highs in the coming sessions.