Whales Offload 270M ADA Amid Geopolitical Tension

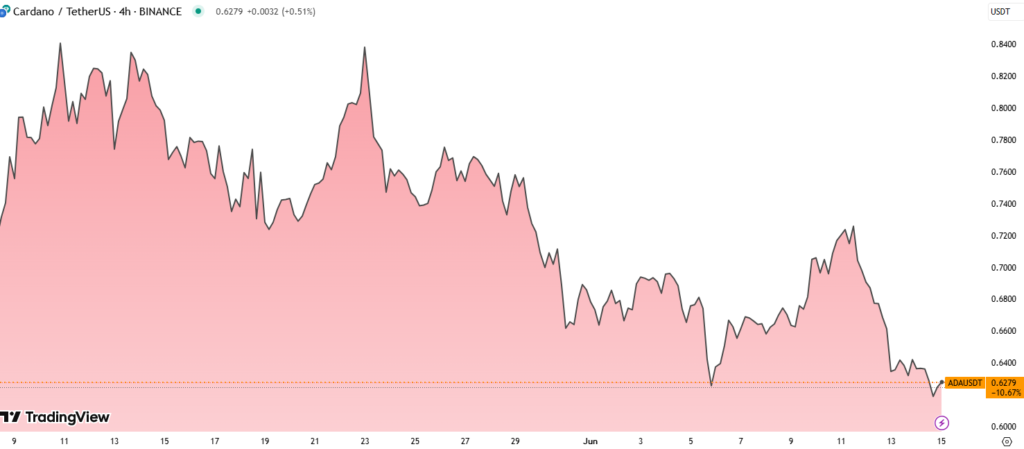

Cardano’s ADA is showing signs of stability around the $0.62 level despite facing intense sell pressure. Over the past week, whale wallets reportedly sold more than 270 million ADA, equivalent to approximately $170 million, weighing on market sentiment as global tensions escalate.

ADA traded at $0.6229, down 1.71% in the last 24 hours, after briefly dipping to $0.6176. The decline coincided with a broader risk-off mood across crypto markets amid Middle East conflict and uncertainty in equities.

Cardano Foundation Launches ‘Originate’ for Enterprise Use

In contrast to bearish market signals, Cardano’s development arm introduced a new enterprise-focused product named Originate. The platform is designed to verify product authenticity and enhance supply chain transparency for global brands.

Originate allows companies to digitize and trace product data on-chain, providing real-time verification for consumers, regulators, and partners. The initiative aligns with Cardano’s strategy to move beyond DeFi into real-world utility, offering regulatory compliance tools in industries vulnerable to counterfeiting.

This launch may help strengthen institutional trust in the Cardano ecosystem — a strategic move during a time when large investors dominate market direction and are seeking blockchain applications with tangible business value.

ADA Added to Nasdaq Crypto Index

ADA also received a symbolic boost this week by being added to the Nasdaq Crypto Index, joining blue-chip digital assets such as Bitcoin and Ethereum. This inclusion enhances ADA’s institutional visibility, potentially opening doors for broader investment vehicles in the future.

Technical Picture: Resistance at $0.645, Downward Trend Intact

From a technical standpoint, ADA ranged between $0.6176 and $0.6428, closing near the lower end at $0.6229. The price broke below short-term support at $0.636, while resistance remains firm around $0.642–$0.645.

- Volume surged after 18:00 GMT, following a sharp decline below $0.62, which triggered panic selling before stabilizing.

- Bearish trend persists, with lower highs forming intraday and continued rejection near $0.635.

- Despite weakness, price action is showing signs of near-term consolidation.