The Bitcoin network’s mining difficulty has slightly decreased after reaching an all-time high of 126.9 trillion on May 31. As of now, difficulty stands at approximately 126.4 trillion, reflecting a minor adjustment in the face of continued pressure on miners.

Mining Becomes More Challenging Post-Halving

This change comes as Bitcoin miners navigate increasing economic challenges. Following the April 2024 halving, block rewards were reduced, squeezing miner profit margins. Combined with higher network hashrates and energy costs, miners are finding it harder to maintain profitability.

“Higher difficulty and hashrate signal intensified competition and rising production costs,” according to industry data.

As of early June, Bitcoin’s hashrate exceeded 1 zetahash per second (ZH/s) — marking a major milestone for the protocol’s computing power but posing further economic strain on smaller and mid-tier mining operations.

Public Miners Expand Despite Headwinds

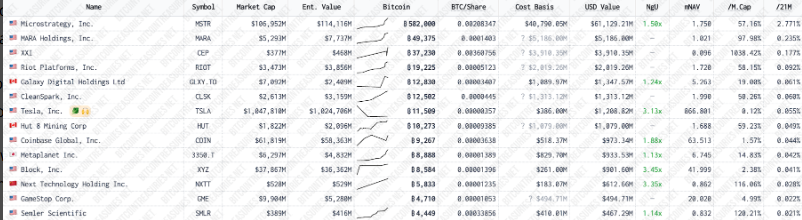

In contrast to the broader mining landscape, several publicly traded mining firms are bucking the trend. These companies are not only increasing their BTC output but are also adopting a Bitcoin treasury strategy—holding mined BTC instead of selling to fund operations.

One notable miner increased its BTC output by 35% in May, mining 950 BTC and raising its reserves to 49,179 BTC. This approach underscores a long-term bullish stance, emphasizing BTC as a strategic reserve asset.

Another firm focusing on sustainable mining reported a 9% increase in production, mining 694 BTC in May and expanding its reserves to 12,502 BTC. The company also increased its hashrate to 45.6 EH/s, reflecting ongoing investment in infrastructure.

Shift Toward Bitcoin as a Treasury Reserve

A growing number of mining firms are now retaining their BTC holdings, signaling a strategic pivot from previous models that relied on liquidating mined coins to manage cash flow.

“Record production — and we sold zero Bitcoin,” one CFO noted in a public statement, reinforcing this emerging trend.

Conclusion

While Bitcoin mining difficulty remains near record levels, a subtle decline offers slight relief to the sector. At the same time, the trend of institutional miners holding Bitcoin as a treasury asset could reshape the industry’s financial structure—transforming miners from sellers into long-term holders in the digital asset economy.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.