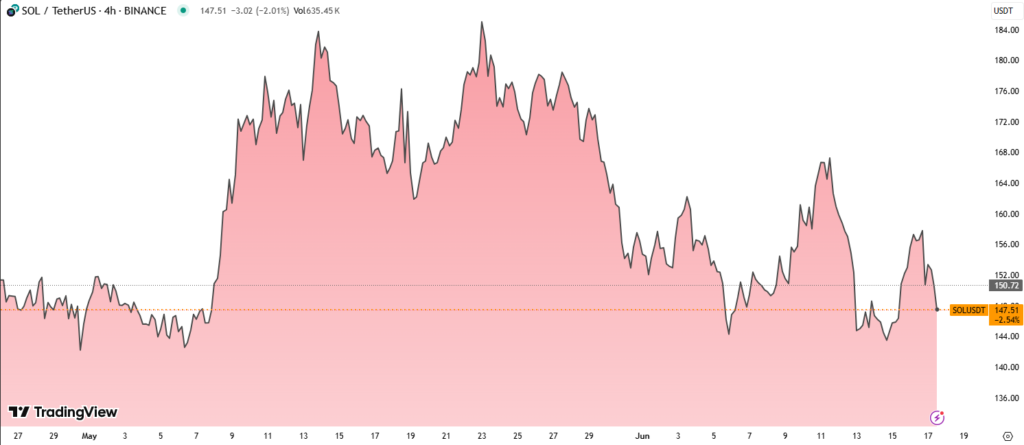

Solana (SOL) saw a sharp correction on Tuesday, falling below the $150 mark after a wave of heavy selling pressure late in the U.S. trading session. Despite this drop, institutional interest in Solana remains strong, with several investment firms highlighting its growing appeal as a high-performance blockchain network.

Sell-Off Triggers Market Reaction

In the last 24 hours, SOL dropped 4.24%, sliding from an intraday high of $158.54 to a low of $148.68. The most intense price action occurred between 22:00 and 00:00 UTC, during which volume surged past 2.7 million SOL. This sell-off broke through key support at $155, sparking concerns of a deeper retracement.

After the sharp fall, SOL briefly stabilized around $152, then entered a tight range between $151 and $154, suggesting temporary equilibrium between buyers and sellers. The $152–$153 level, once a support zone, has now become resistance, indicating short-term bearish momentum.

Institutional Backing Remains a Key Driver

Despite the recent volatility, institutional sentiment around Solana continues to strengthen. Major financial firms have begun coverage of companies holding SOL as a treasury asset, viewing the token as a serious alternative to Ethereum.

Analysts highlight Solana’s technical advantages, including:

- Faster transaction speeds

- Lower latency

- Rapid developer adoption

These strengths are backed by on-chain metrics, which show that Solana is experiencing faster ecosystem growth compared to Ethereum, although ETH still commands a significantly higher market cap.

Can SOL Hold Key Support Levels?

Currently, traders are closely watching whether SOL can hold the $148–$150 support range. A breakdown below this zone could open the door for further downside. However, if SOL holds firm and reclaims levels above $153, it could signal a resumption of bullish momentum.

Technically, the market has entered a consolidation phase, with declining volatility suggesting indecision. Bulls and bears appear to be waiting for the next catalyst before taking positions.

Conclusion

Although Solana has experienced a short-term price correction, the long-term outlook remains supported by strong institutional adoption and technical performance. If the $148–$150 range holds, it could serve as a launchpad for a potential rebound, especially if broader market conditions stabilize.

Solana remains a key asset to watch as it continues to challenge Ethereum’s dominance with real-world usage, speed, and scalability advantages.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.