Global markets have already moved on from the Israel-Iran conflict, signaling minimal disruption to Despite the ongoing military tensions between Israel and Iran, global markets have shown remarkable resilience. Investors seem convinced that this geopolitical flare-up will not spiral into a crisis capable of derailing economic recovery or impacting long-term financial trends.

Markets Signal “Risk-On” Despite Rising Tensions

The most telling sign of market confidence is the behavior of traditional risk indicators. Stock markets rebounded, Treasury yields rose, and volatility dropped — all signals of renewed risk appetite.

“The Israel-Iran conflict is over, as far as the markets are concerned.”

One would expect escalating military exchanges to boost safe-haven demand. Yet, gold prices fell by nearly 1% on the day following Israel’s strikes. Meanwhile, West Texas Intermediate (WTI) crude oil remains at $72, well below levels that would threaten inflation or growth.

Historically, equities fall an average of 6% after geopolitical shocks, but typically recover within three weeks. In this case, recovery was immediate — showing that institutional investors see limited economic fallout from the conflict.

Short-Term Market Volatility

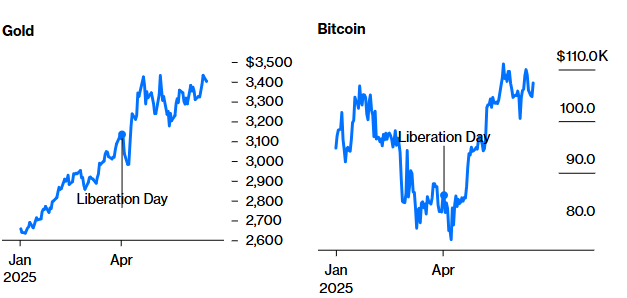

Following the initial attacks, Bitcoin and other major cryptocurrencies experienced sharp price fluctuations. Bitcoin dropped briefly before recovering, showcasing its sensitivity to geopolitical risks. Altcoins, particularly those tied to Middle Eastern markets, saw increased volatility as traders reacted to news updates. The uncertainty has led to heightened trading volumes, with investors moving funds between safe-haven assets like gold, the U.S. dollar, and cryptocurrencies.

Increased Demand for Crypto in the Middle East

In regions directly affected by the conflict, such as Iran, cryptocurrencies have become a crucial tool for financial transactions. With strict sanctions limiting access to traditional banking, many Iranians rely on Bitcoin and stablecoins like USDT to preserve wealth and facilitate cross-border payments. The war has further accelerated crypto adoption in the region as people seek alternatives to unstable local currencies.

Iran’s De-escalation and Israel’s Confidence Shape the Narrative

There is growing evidence that Iran is signaling a desire to de-escalate, while Israel maintains the upper hand militarily. Analysts estimate:

- 20% chance of Iran backing down voluntarily

- 45% probability of Israel achieving its objectives without major escalation

- Only 10% risk of a nuclear breakout or serious regional spillover

These odds reflect the broader view that energy markets will stay stable, with limited threats to oil supply chains, including the Strait of Hormuz.

“Game theory suggests Iran is unlikely to block Hormuz, as it would isolate them globally — including from allies like China.”

Bitcoin and Oil: New Roles in a Changing Market

Interestingly, Bitcoin gained over 4.9% during this period, signaling that investors are increasingly treating digital assets as speculative risk assets, not just safe havens. This stands in contrast to gold, which underperformed despite the geopolitical risk environment.

Institutional interest in Bitcoin is growing, driven by a shift toward digital assets with yield potential and cash flow, rather than purely speculative value.

Meanwhile, oil markets remain stable. Despite fears of a supply shock, spare production capacity and alternative pipelines in Saudi Arabia reduce dependency on vulnerable routes like Hormuz. This technical flexibility contributes to the market’s calm.

Tail Risks Remain — but Market Complacency Is High

Although the markets have priced in a soft outcome, strategic missteps, political instability, or unexpected escalations could still disrupt the balance. Bombing Iran’s state television signals a push for regime change, which introduces long-term uncertainty even if it doesn’t affect markets immediately.

“It’s probably going to be OK — but the risk of something going very wrong is still too high to ignore.”

Conclusion: A Conflict That Markets Already Discounted

The financial world seems to believe that this conflict, like others before it, will resolve without lasting economic damage. Investor focus has shifted to earnings, rate cuts, and AI-driven growth, rather than war or energy disruptions.

However, history reminds us that geopolitical risk is unpredictable. While markets often recover quickly, investors should remain cautious about overconfidence during volatile times.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.