Ethereum (ETH) is showing remarkable resilience amid global market turbulence, defending the $2,500 support level despite geopolitical shocks from escalating Israel-Iran tensions. Analysts point to growing signs of bullish momentum forming under the surface.

$2,500 Emerges as a Critical Technical Floor

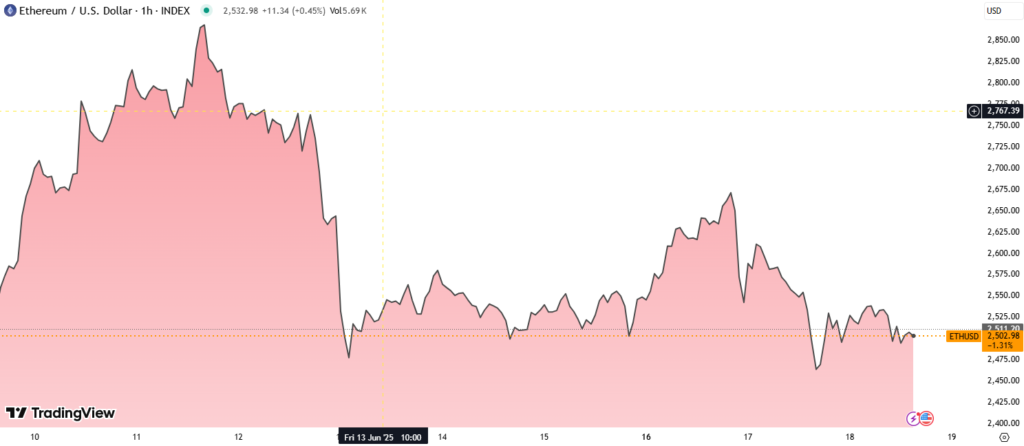

Over the past 24 hours, Ethereum traded within a 4.05% range, moving from $2,564 to a low of $2,455 before rebounding. This action was supported by strong trading volume around the $2,470–$2,500 zone, signaling solid buying interest and accumulation rather than distribution.

The $2,500 level has successfully repelled multiple downside tests, reinforcing it as a key level for short-term support.

ETH is currently consolidating between $2,500 and $2,540, a range where volume has been gradually decreasing—a classic pattern indicating buyers are quietly accumulating positions.

Bullish ‘Golden Cross’ Signal on the Horizon

Technical analysts highlight that Ethereum may be nearing a “golden cross”, a historically bullish signal that occurs when the 50-day moving average crosses above the 200-day.

This pattern has previously marked the beginning of major upward trends, especially when combined with strong support levels and reduced selling pressure.

The growing anticipation of this technical setup is adding confidence to the bulls, who are targeting a breakout past the key resistance at $2,800.

Short-Term Price Action and Volume Trends

During the observed trading window:

- ETH surged from $2,506 to $2,517 around 11:43 AM on high volume.

- A brief pullback followed, with selling pressure capping gains near $2,515.

- Price declined to $2,503, forming a V-shaped recovery and reaffirming short-term support between $2,503 and $2,504.

These movements indicate a healthy correction and reset before a potential continuation of the uptrend.

Long-Term Bullish Catalyst: Staking Hits Record High

Over 35 million ETH is now staked, reducing circulating supply significantly. This long-term factor supports price stability and upward bias, especially in periods of macro uncertainty.

Reduced supply, strong technical support, and accumulation patterns are aligning in Ethereum’s favor.

Conclusion

Ethereum’s defense of the $2,500 level—combined with the possible formation of a golden cross and surging staking activity—signals growing strength in the face of global uncertainty.

A confirmed breakout above $2,800 could open the path toward the $3,000 mark, making this a crucial watch period for ETH traders and investors.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss