BlackRock’s iShares Bitcoin Trust (IBIT) has quickly become a major force in the crypto market, now holding over 3.25% of the total Bitcoin supply. As of mid-June 2025, IBIT has amassed $69.7 billion in assets under management (AUM) — making it the largest U.S. spot Bitcoin ETF by market share.

Institutional Inflows Power ETF Growth

BlackRock now controls over 54.7% of the market share among all U.S. spot Bitcoin ETFs, which collectively hold around 6.12% of the total circulating BTC supply, according to Dune Analytics.

Since U.S. spot Bitcoin ETFs launched in January 2024, IBIT’s explosive growth reflects institutional confidence in Bitcoin as a long-term asset. The fund has even entered the top 25 ETFs globally, ranking 23rd across both traditional and crypto markets, as per VettaFi data.

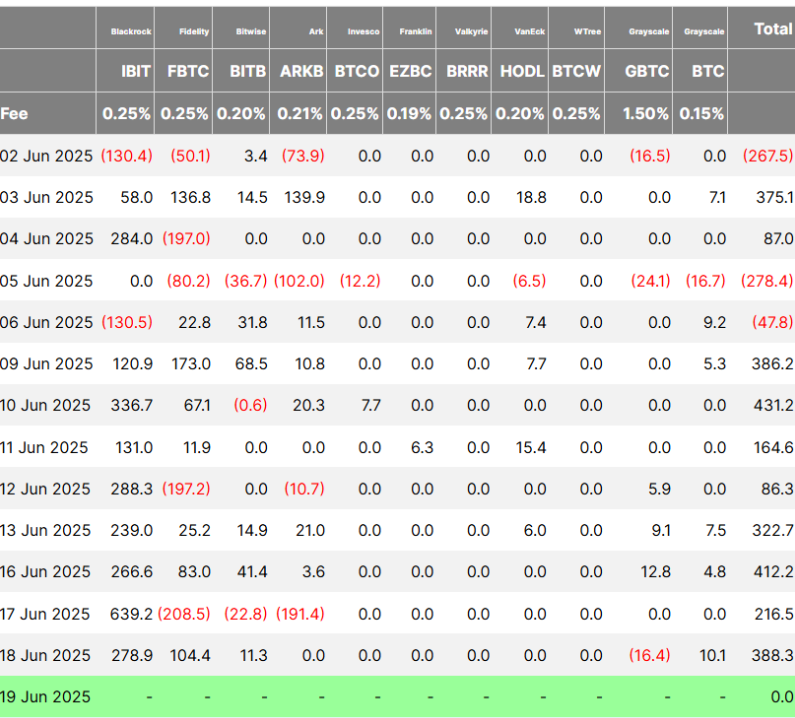

Meanwhile, U.S. Bitcoin ETFs have seen eight consecutive days of net inflows, with a total of $388 million added in a single day this week, Farside Investors reports.

Retail Momentum Slows as ‘New Money’ Declines

Despite strong institutional flows, retail interest appears to be waning. Data from CryptoQuant shows a drop of over 800,000 BTC held by short-term holders, now sitting at just 4.5 million BTC — a sign that new money is drying up in the market.

High-Value Transfers Dominate Bitcoin Network

On-chain analytics from Glassnode reveal that Bitcoin transactions are now dominated by large investors. The average transaction value is $36,200, and over 89% of all transactions exceed $100,000. This shift highlights how high-net-worth entities are increasingly driving network activity, even as total transaction volume dips.

“A breakout may need a new catalyst or sentiment shift,” noted Nexo analyst Iliya Kalchev, citing that long-dormant wallets are currently absorbing more supply than miners are producing.

Final Thoughts

While retail participation is cooling, institutional adoption continues to surge. BlackRock’s IBIT ETF is not only a landmark in the evolution of Bitcoin investment products — it also signals a structural shift toward large-scale accumulation.

If current trends persist, Bitcoin’s price action may become increasingly influenced by institutional treasuries, corporate investors, and ETF flows — rather than retail hype alone.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.