Bitcoin (BTC) is maintaining its grip near $106,000, gaining 0.9% over the past 24 hours, as crypto markets reacted to U.S. President Donald Trump’s decision to delay military involvement in the escalating Israel-Iran conflict. The broader crypto index also edged higher, with the CoinDesk 20 up 0.77%, signaling a temporary easing of geopolitical stress in the markets.

Trump’s Pause Cools Global Tensions—For Now

In a widely watched move, President Trump announced a two-week hold on any decision to engage militarily in the Middle East, sharply cutting war odds on prediction platform Polymarket. The probability of U.S. action before June’s end has fallen from 70% to 40%, while July odds dropped from 90% to 62%.

This de-escalation pushed oil prices down 1.7%, ended a three-week rally, and buoyed both European stock indexes and U.S. equity futures, lifting crypto sentiment as well.

“Markets are breathing easy for now, but the two-week delay keeps uncertainty on the radar,” noted AJ Bell analyst Dan Coatsworth.

Glassnode and CryptoQuant Sound Diverging Alerts

While on-chain activity appears subdued, Glassnode analysts argue this may reflect a mature, institution-driven market, where fewer but larger transactions dominate the blockchain.

But not all analysts share this optimism.

CryptoQuant’s latest report highlights troubling signs beneath the surface:

- ETF inflows have dropped by 60% since April.

- Whale activity (wallets holding large BTC amounts) has declined by nearly 50%.

- Short-term holders offloaded over 800,000 BTC since late May.

These combined factors, according to CryptoQuant, could lead to a retracement toward $92,000 if demand doesn’t stabilize quickly.

Investor Outlook: Consolidation or Correction?

Bitcoin’s resilience above $100,000 is notable, but risks remain. ETF momentum is fading, and macro uncertainty lingers with U.S. policy in flux. Analysts warn that a lack of retail inflows or fresh institutional catalysts could trigger a deeper pullback.

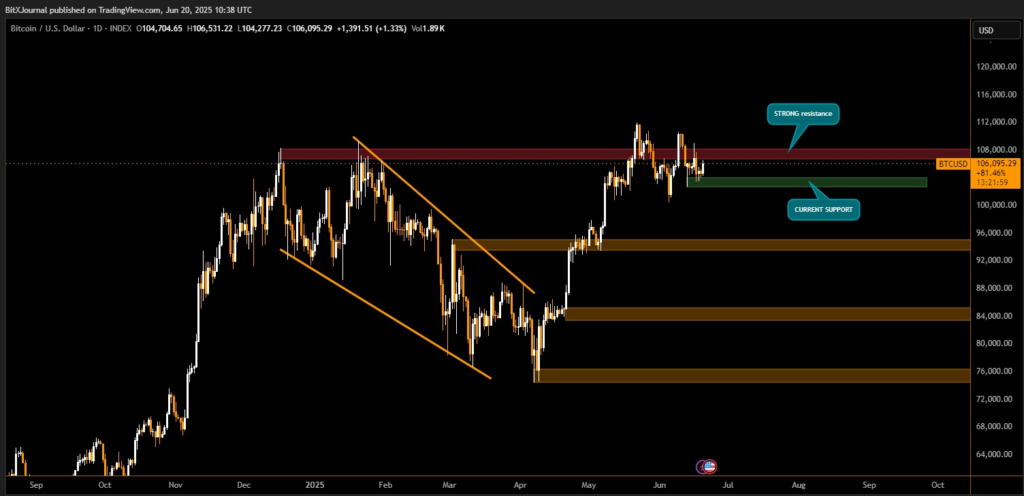

Key support sits at $102,500, while resistance continues around $107,800–$108,500.

Conclusion

The short-term outlook hinges on Trump’s geopolitical posture and capital flows into crypto ETFs. While bulls celebrate temporary relief, analysts urge caution. If Bitcoin breaks below key support without renewed buying, the $92,000 zone could come into play.

Stay alert as market dynamics evolve heading into July.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.