Ether Faces Institutional Pressure With $11.3M Outflows

Ethereum (ETH) faced intense selling pressure on Friday, June 20, dropping over 4% to an intraday low of $2,372.85, its steepest daily slide in June. The decline coincided with the largest single-day net outflows from U.S.-listed spot ETH ETFs this month — totaling $11.3 million, as per data from Farside Investors.

The outflow was led by BlackRock’s ETHA, which saw a withdrawal of $19.7 million, its first negative flow in June.

Other major players reacted differently:

- Grayscale’s ETHE added $6.6 million

- VanEck’s ETHV recorded $1.8 million in inflows

No other ETF issuers reported notable flows.

Trading Volume Surges Amid Rebound

Despite the sell-off, ETH quickly staged a technical recovery, bouncing from the lows and closing near $2,445. During this rebound:

- 24-hour volume surged 18.97% above the 7-day average

- Intraday trading range was $186.44 — a 7.25% swing

- Volume spiked nearly 5x the daily average during the 17:00 hour crash

The bounce formed a key support zone between $2,420 and $2,430, confirmed by multiple low-volume retests, signaling early signs of accumulation.

Technical Setup Hints at Stabilization

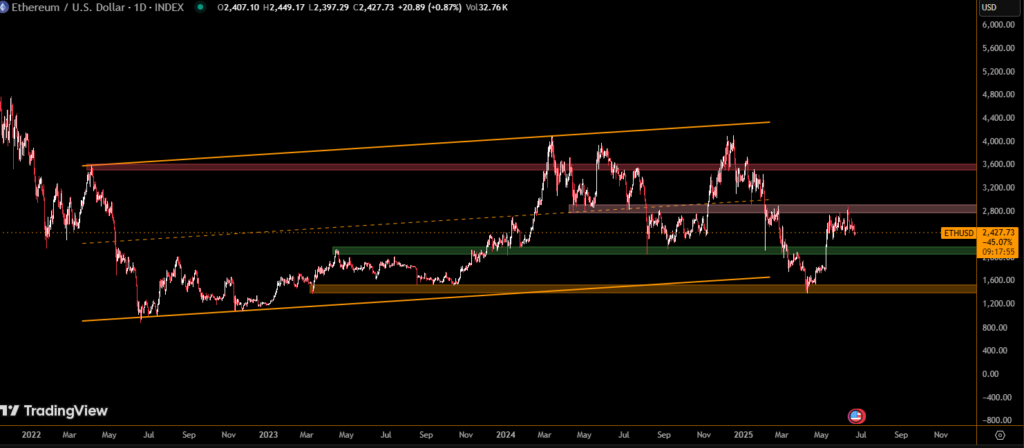

ETH’s technical chart reflects a gradual bullish recovery:

- The price reclaimed 38.2% Fibonacci retracement from the drop

- An ascending trendline of higher lows formed, signaling short-term momentum

- Volume bursts during the 08:00–09:00 UTC hour and a late-session rally to $2,447.02 reinforced buyer strength

ETH closed the session in a tight range between $2,440 and $2,445, showing price stabilization near the trendline.

Conclusion: Bearish Flows, Bullish Signs

ETH remains under pressure due to institutional outflows, but the rapid recovery, volume dynamics, and technical support zone suggest the sell-off may have triggered accumulation rather than a broader collapse.

Key resistance lies at the $2,480–$2,500 level. A breakout above this zone could renew bullish sentiment, while failure to hold above $2,420 may invite another leg down.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.