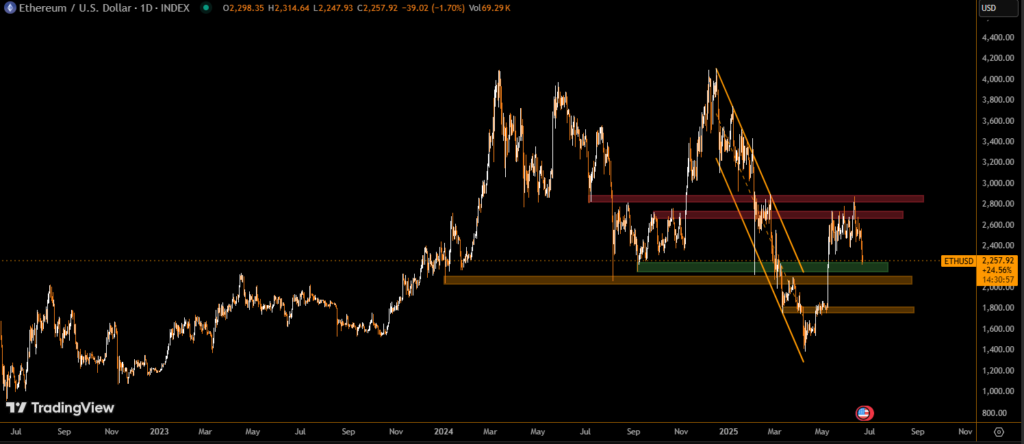

Ether Sees High-Volume Selloff Before Rebounding Into New Ascending Channel

Ethereum (ETH) experienced a sharp 7.56% drop on June 21 during the 21:00 hour, plunging from $2,406 to $2,224 in what traders are calling a flash crash. The sudden selloff triggered a surge in trading volume, with over 751,000 ETH exchanged—nearly five times the average hourly volume.

Massive Volume Fuels Fast Recovery

Despite the steep drop, ETH saw immediate buyer interest near the $2,250 support zone. Within the next few hours, the price rebounded steadily to $2,292, with increased liquidity supporting the recovery. At 05:58, a notable 3.15% price surge from $2,283.94 to $2,291.09 occurred on 7,314 ETH volume, confirming that buyers had regained control.

This price action led to the formation of a short-term ascending channel, marked by a series of higher lows, suggesting bullish momentum returning to the market.

Technical Breakdown

- Crash Depth: ETH dropped from $2,406 to $2,224 (-7.56%) during the 21:00 hour

- Volume Spike: Over 751,000 ETH traded, nearly 5x the norm

- Support Levels: First at $2,250, second around $2,290

- Price Jump: At 05:58, ETH climbed 3.15% in one move

- Resistance Zone: Seen near $2,297, tested during 06:17–06:20

- Recovery Trend: Formation of an ascending channel, indicating sustained buyer pressure

Market Context and Sentiment

The flash crash appears to be an isolated liquidity event rather than a fundamental breakdown, as no macro or on-chain catalyst was immediately identified. The strong rebound, coupled with elevated trading volume, reflects a healthy market response and potential setup for continued short-term upside—provided ETH can sustain above $2,290 support and clear resistance near $2,297.

Traders are watching closely as Ethereum continues to rebuild structure following the volatile move. The return of higher lows and volume-backed buying suggests market confidence remains intact.

Conclusion

Ethereum’s ability to recover swiftly from a sharp crash underscores its resilience in volatile conditions. With support zones holding firm and a new ascending structure forming, ETH is showing signs of stabilization. Market participants will now look for confirmation above resistance levels to validate a broader trend reversal.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.