Bitcoin experienced a sharp decline over the weekend, falling below $102,000, after former U.S. President Donald Trump confirmed military strikes on Iranian nuclear sites, triggering renewed geopolitical tensions across the Middle East. As of June 22, BTC/USD was hovering near $100,948, risking its lowest weekly close since early May.

War Headlines Stir Market Volatility

The market reacted quickly to Trump’s televised statement, in which he warned Iran to “make peace or face additional strikes.” The confirmation of U.S. military action injected uncertainty into both traditional and crypto markets, historically known to react strongly to such developments.

Some traders believe this pullback could offer a buying opportunity, referencing past war-related catalysts. In 2022, for instance, Bitcoin surged over 40% within a month of the Ukraine conflict escalation — despite the bear market conditions at the time.

“Now it’s 2025. War fears rise again. But Bitcoin’s above $100K. And we’re still in a bull market,” noted one trader. “What happens if history repeats with more fuel?”

$97,000 Support Zone Under Watch

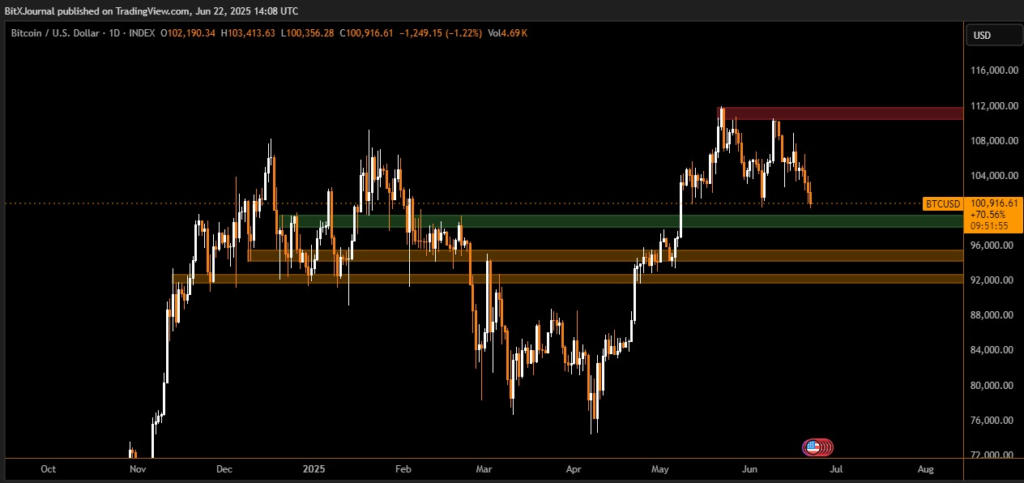

Technical analysts are now focusing on the $97,000–$98,000 liquidity zone, where strong order book support appears to be forming. According to monitoring data, this area may provide the first significant support level if the selling pressure continues.

Another closely watched level is $93,000–$94,000, although traders assign only a 20–25% chance of Bitcoin dropping that far in the short term.

“I remain long over $93,500,” shared a trader, “but we must hold $104,500 for bulls to remain in control.”

Weekly Close Becomes Critical

With the weekly close approaching, bulls are under pressure to defend key levels. A close below $101,000 would mark the weakest performance in over a month and potentially signal further weakness ahead.

As of now, the market remains volatile and sentiment is fragile. However, historical patterns suggest that BTC could rebound strongly if the conflict stabilizes or investors begin to see Bitcoin as a hedge against geopolitical instability.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.