Bitcoin is fast becoming the preferred choice for crypto speculators looking to escape declining altcoins. According to Adam Back, CEO of Blockstream and inventor of Hashcash, Bitcoin treasury adoption by public companies is emerging as the new “altseason” — but with a different twist.

From Altcoins to Bitcoin Treasuries

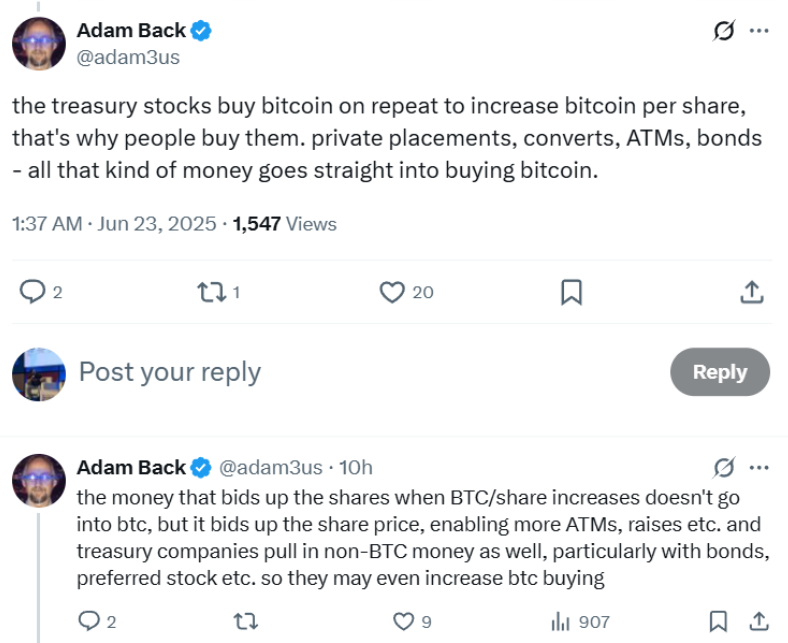

In a recent post, Back stated that “Bitcoin treasury season is the new ALT SZN for speculators”, urging investors to pivot from altcoins to either Bitcoin or BTC-focused treasury firms. These firms, he noted, are accumulating BTC aggressively to increase Bitcoin-per-share metrics, often leveraging funding tools like convertible notes.

This strategy is resonating across the corporate world. The number of public companies holding Bitcoin has doubled in just weeks, rising from 124 to over 240 firms, now representing approximately 3.96% of the total BTC supply, based on data from BitcoinTreasuries.NET.

Metaplanet and MicroStrategy Lead the Trend

Japanese firm Metaplanet and U.S.-based MicroStrategy remain key players in this wave. Metaplanet’s stock has traded at an enormous premium relative to Bitcoin, with its BTC exposure priced at over $596,000 per Bitcoin equivalent — more than five times the spot value.

While this highlights investor enthusiasm, it also introduces risks for shareholders, especially as speculation inflates share premiums beyond the value of underlying BTC holdings.

Institutional Interest Accelerates Globally

The corporate rush into Bitcoin is expanding rapidly. Just this month:

- Mercurity Fintech Holding (Nasdaq) revealed plans to raise $800 million to build a long-term Bitcoin reserve.

- The Blockchain Group (France) disclosed plans to raise $340 million for BTC accumulation.

- Interactive Strength, a Nasdaq-listed company, even announced a $500 million fundraising round to build a Fetch.ai (FET) token treasury — indicating broader interest beyond Bitcoin alone.

Bitcoin as a Recovery Strategy for Altcoin Traders

Adam Back also suggested that Bitcoin treasuries could serve as a recovery path for altcoin losses, noting that moving funds from altcoins into BTC-focused firms might offer a second chance at profitability.

With more public companies joining the Bitcoin bandwagon, the line between traditional finance and crypto continues to blur — and Bitcoin remains at the center of this financial convergence.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.