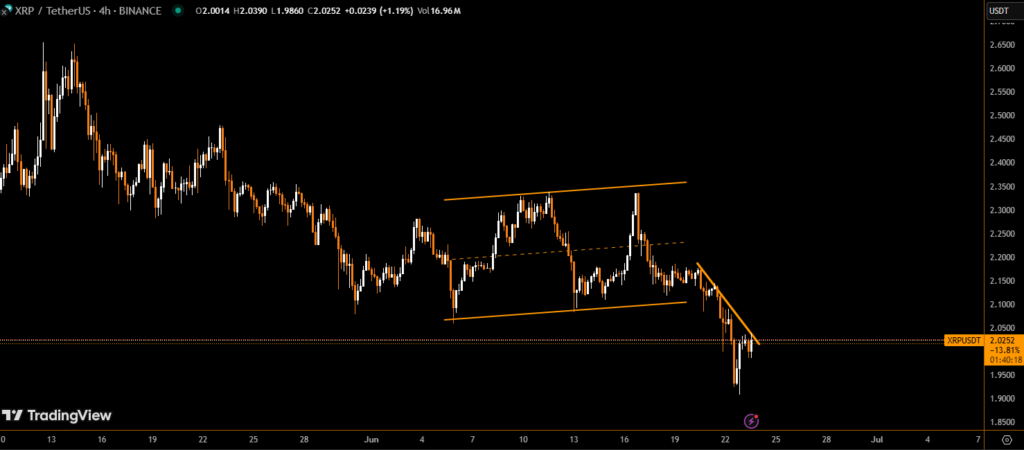

XRP has reclaimed the $2 level, bouncing back strongly after a dip to $1.91, while NEAR Protocol has surged 7.4% from recent lows, signaling renewed investor interest despite continued geopolitical and economic uncertainty.

XRP’s Momentum Rebuilds Amid ETF Hype and Institutional Interest

XRP’s return above $2 follows a sharp sell-off last week triggered by Middle East tensions and global market jitters. However, institutional accumulation and ongoing ETF developments have helped restore confidence in the Ripple-backed token.

XRP futures volume soared to $4 billion, indicating aggressive long positioning and heightened trader activity.

This recovery reflects a broader shift in sentiment as investors begin rotating back into major altcoins with promising institutional narratives.

NEAR Protocol Finds Support, Enters Uptrend Channel

At the same time, NEAR Protocol (NEAR) has demonstrated strong resilience. After plunging to $1.79, the token rebounded to $1.94, settling near $1.906 at the latest hourly close. The move established solid support at $1.83, aided by surging trading volume.

Key Technical Insights:

- Trading range: $1.79 – $1.94 over 24 hours

- Support zone: Firm support built at $1.83, with intense buying interest during high-volume periods

- Resistance level: Price tested $1.94 before consolidating between $1.90–$1.92

- Volume spike: Peak trading activity at 11:38, exceeding 30 million units

- Price structure: Clear ascending channel formed, with higher lows at 1.899, 1.904, and 1.906

- Recovery momentum: Brief pullbacks were quickly absorbed, suggesting $1.90 now acts as strong intraday support

Market Outlook: Bullish Continuation or Pause?

Both XRP and NEAR are showing bullish technical setups. XRP’s breakout above $2 may draw further institutional inflows if ETF speculation gains traction. For NEAR, volume-backed recovery and a stable price channel suggest it could test the $2 mark again if macro conditions remain steady.

However, broader market recovery will depend on:

- Geopolitical developments

- U.S. economic indicators (PCE, interest rate outlook)

- Crypto regulatory sentiment

Conclusion

With XRP reclaiming $2 and NEAR rebounding 7.4%, the altcoin market is showing early signs of strength after a turbulent weekend. Sustained buying pressure and high trading volume point to growing investor confidence, though caution remains due to external macro factors.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.