Despite Token Crash, Celestia Claims 6-Year Runway and Industry Leadership in DA Market

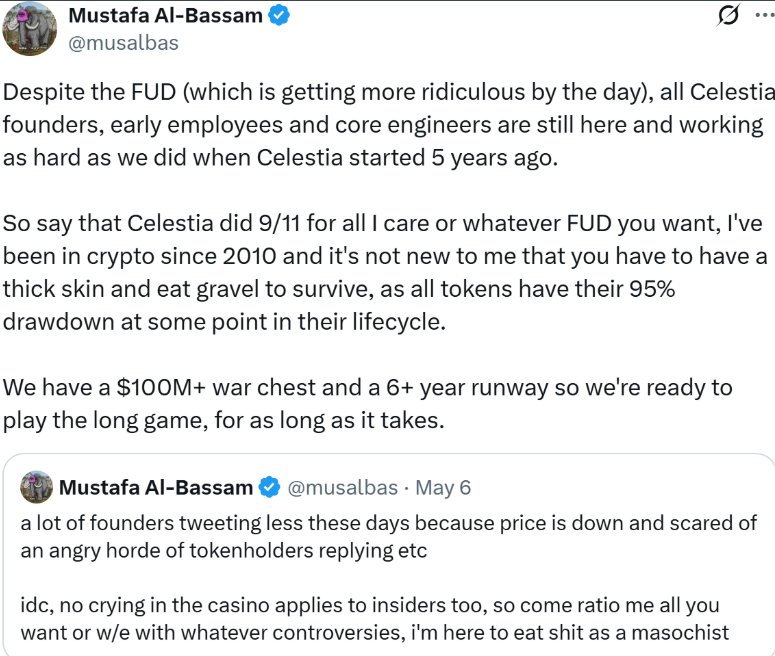

As accusations mount against Celestia’s leadership over insider sales and market manipulation, co-founder Mustafa Al-Bassam is breaking his silence — dismissing the claims as “ridiculous FUD” and asserting that the project remains financially strong and fully committed to its long-term roadmap.

“All Celestia founders, early employees, and core engineers are still here and working as hard as we did when Celestia started five years ago,” Al-Bassam wrote on X.

He pointed to a $100M+ treasury and 6+ year runway as proof that the team is not abandoning the project despite TIA’s 92% crash from its all-time high of $20.91 to $1.61.

Critics Slam Insider Moves, Tokenomics, and Marketing Strategy

Celestia’s defense comes amid a storm of backlash on X, led by anonymous researcher Startup Anthropologist, who alleged that the Celestia team dumped tens of millions of dollars worth of tokens shortly after unlocks began in late 2024.

Claims include:

- Al-Bassam allegedly sold $25M+ OTC before relocating to Dubai

- Prominent influencers were paid to promote $TIA while insiders offloaded

- Unlock schedules were designed to favor early investors over retail

One critic summarized the mood: “They rewarded themselves and early VCs, then played victim when retail investors were left holding the bag.”

Celestia’s Role in the DA Landscape

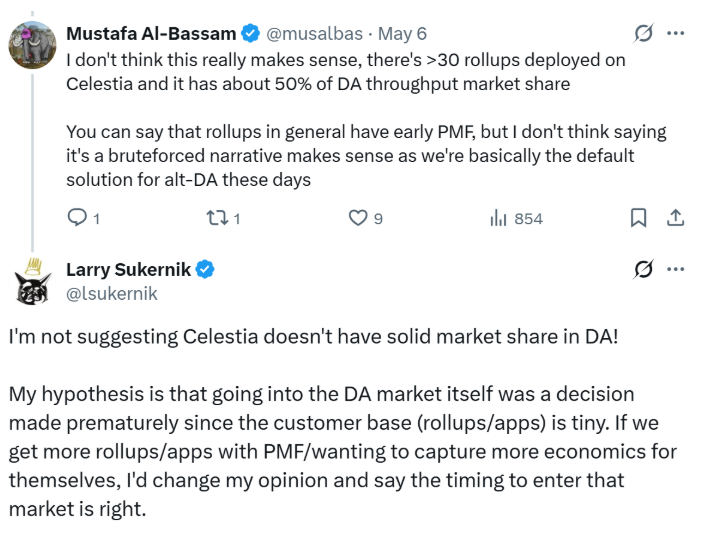

Beyond the controversy, Al-Bassam emphasized Celestia’s leading position in the data availability (DA) market, stating that over 30 rollups are actively using Celestia, which now accounts for around 50% of DA throughput.

“We’re basically the default solution for alt-DA these days,” he added.

Still, some industry analysts argue that Celestia may have entered the DA market too early, with limited real economic demand despite its growing technical footprint.

What’s Next for TIA and Celestia?

At the time of writing, Celestia’s token (TIA) has bounced 14% in the last 24 hours, trading near $1.61. However, the project continues to face trust issues from the community.

With a $100M reserve, a six-year operational buffer, and increasing on-chain adoption, Celestia may survive the storm — but regaining retail confidence will be a far tougher battle.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.