Bitcoin is trading sharply higher on June 24, with the price climbing over 3% to around $105,000, continuing a broader upward trend. A combination of geopolitical relief, ETF inflows, and bullish technical signals are driving the latest surge in BTC’s value.

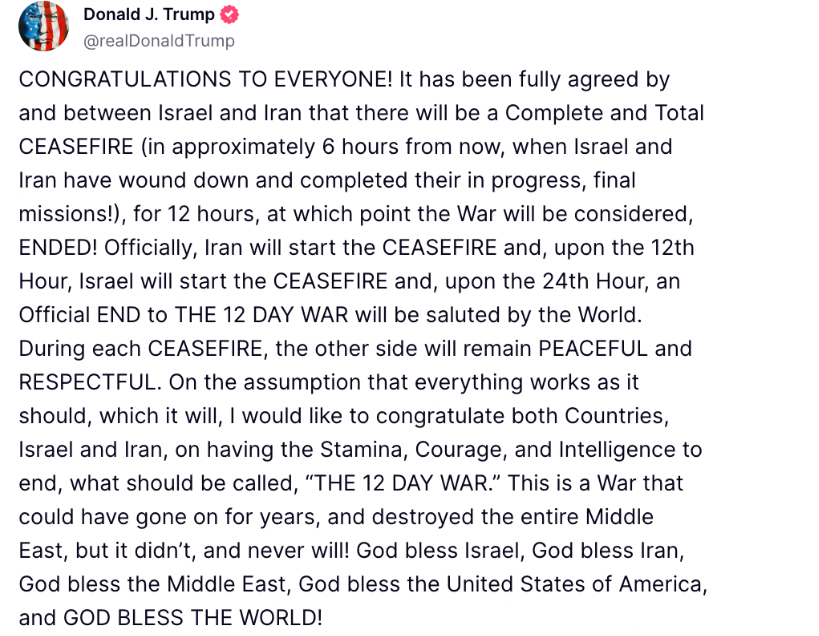

1. Ceasefire Between Israel and Iran Lifts Risk Appetite

The biggest catalyst behind today’s rally is the surprise ceasefire agreement between Israel and Iran, announced by U.S. President Donald Trump. The ceasefire ends a 12-day war that included strikes on Iranian nuclear sites and retaliatory attacks.

Global tensions had pushed Bitcoin below $100,000 just days ago. The announcement has calmed markets, restored risk appetite, and triggered a swift rebound.

With fears of prolonged geopolitical disruption subsiding, investors are rotating back into risk assets, including cryptocurrencies. Bitcoin briefly topped $106,100 on June 23 before consolidating near $105,000.

2. Spot Bitcoin ETFs See Consistent Inflows

Capital inflow into spot Bitcoin ETFs remains a strong bullish force. ETFs saw $350.6 million in inflows on June 24 alone, according to Farside Investors, marking the 10th consecutive day of net inflows.

Cumulative ETF inflows have surpassed $49.9 billion since their debut in January 2024.

In parallel, institutional sentiment is bullish, with crypto investment products receiving $1.24 billion last week alone. Of that, $1.1 billion flowed into Bitcoin-focused funds, highlighting confidence in BTC as a long-term asset.

Corporate accumulation is also picking up. Notably, firms like Strategy and Metaplanet added to their BTC reserves, with the latter purchasing 1,111 BTC worth $118 million this week.

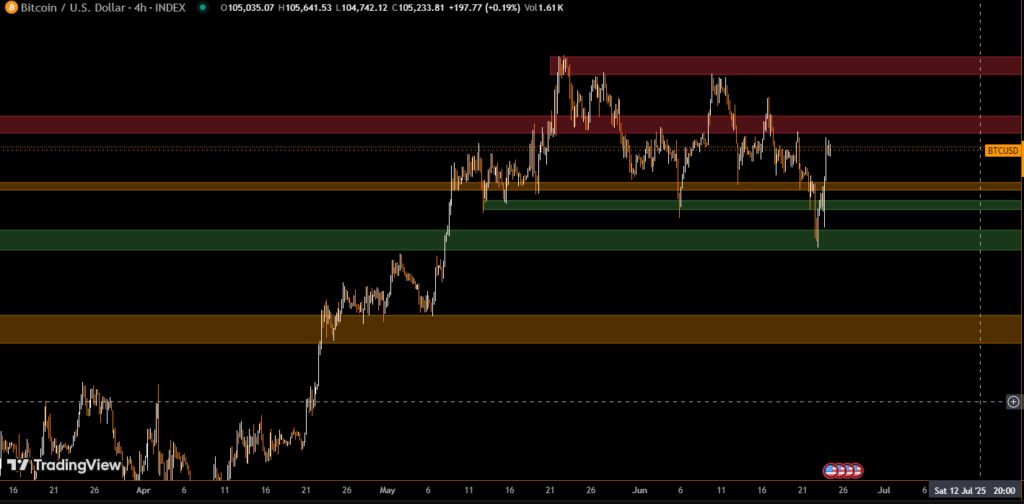

3. Technical Breakout Points to $144,000 Target

Bitcoin’s daily chart is forming a classic cup-and-handle pattern, often seen as a bullish continuation setup.

A breakout above the $105,000 resistance and the 50-day simple moving average could trigger a run toward $109,000 and potentially the previous all-time high at $112,000.

If confirmed, the technical structure projects a measured move to $144,000, a 37% upside from current levels.

Conclusion: Bulls Regain Control

The combination of geopolitical de-escalation, ETF-driven institutional demand, and positive technical momentum is powering Bitcoin higher. As long as support holds above $105,000, a new all-time high may be just around the corner.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.