The Bank for International Settlements (BIS) has issued a strong critique of stablecoins, arguing they are fundamentally flawed as monetary instruments and pose significant risks to global financial systems. In its Annual Economic Report 2025, the BIS stated that stablecoins fail to meet essential benchmarks of modern money—singleness, elasticity, and integrity—and warned of their potential for misuse in financial crimes.

Why Stablecoins Fail to Qualify as Real Money

The BIS defined “singleness” as the uniform acceptability of money at face value. Unlike central bank money, stablecoins are often issued by private entities and may trade at different values depending on platforms or markets. This disrupts the principle of parity, creating fragmentation rather than consistency in monetary exchange.

“Stablecoins perform poorly when assessed against the three tests for serving as the mainstay of the monetary system,” the report emphasized.

Elasticity and Liquidity: Another Shortcoming

The second pillar, “elasticity,” refers to a system’s ability to adapt to liquidity demands during economic shocks. The BIS criticized stablecoins for operating on a “cash-in-advance” basis, where supply is strictly limited to prior funding.

This model lacks the flexibility of traditional banking systems, where central banks can inject liquidity as needed to stabilize financial markets.

Integrity Risks: Crime, Laundering, and Sanctions

The most serious concern outlined was the lack of integrity in stablecoin ecosystems, especially those transacted via unhosted wallets and public blockchains. According to the BIS, these mechanisms make stablecoins vulnerable to:

- Money laundering

- Sanctions evasion

- Terrorist financing

“Stablecoins have significant shortcomings when it comes to promoting the integrity of the monetary system,” the report warned.

Stablecoins May Have a Limited, Regulated Role

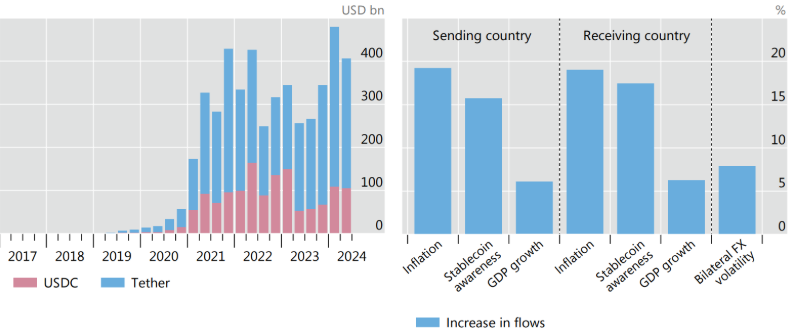

Despite its criticism, the BIS did acknowledge the growing demand for stablecoins, especially in cross-border payments and low-cost transfers. However, it advocated for tight regulation and limited use, stressing that these digital assets should not replace sovereign currencies.

The report further stated:

“Society can re-learn the historical lessons about the limitations of unsound money.”

Tokenization Praised as a Financial Innovation

In contrast to its stance on stablecoins, the BIS described tokenization—the digital representation of real-world assets—as a “transformative innovation.” Unlike stablecoins, tokenized assets are seen as complementary to existing systems rather than disruptive.

Market Reaction and Industry Response

Following the BIS publication, USDC issuer Circle’s stock dropped over 15%, reflecting market concerns about regulatory clampdowns. Industry analysts argued the BIS’s position was unsurprising, given its alignment with central banks.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.