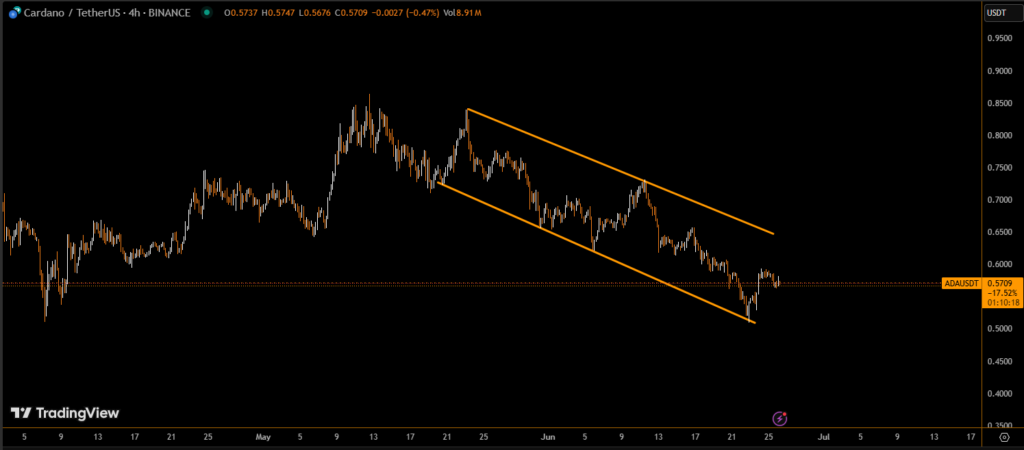

Cardano (ADA) faced renewed selling pressure on June 25, 2025, dropping 2.78% to close near its daily low of $0.5679. Despite brief attempts to rally, the price failed to hold above resistance, signaling continued weakness in the face of broader market uncertainty.

Failed Breakout Rejected Near $0.59

Throughout the trading session, ADA showed signs of bearish momentum as every recovery attempt was capped by lower highs, maintaining a clear descending channel. The day’s 24-hour range was $0.0175 (3.01%), spanning from $0.5928 to $0.5753.

- Failed breakout near $0.59 was met with immediate rejection.

- Despite a brief rally during the 13:00 hour, prices fell shortly after peaking.

This price pattern suggests that sellers remain in control, and short-term bullish attempts are being absorbed by profit-taking or risk-off sentiment.

Volume Analysis Confirms Resistance Zones

ADA’s intraday volume spiked during key price movements, particularly around its failed rebound:

- Highest hourly volume occurred during the 13:00 hour with 63.5M ADA traded.

- A notable candle at 13:45 recorded 3.78M units, indicating intense market activity as buyers attempted to breach resistance.

- Price quickly retreated from $0.585 to $0.582 at 13:51, confirming strong sell pressure at upper levels.

Even as the broader crypto market attempted a modest recovery, ADA lagged behind peers, reflecting relative underperformance.

Key Support Levels to Watch: $0.55–$0.50

With ADA breaking below critical support at $0.576, attention now turns to deeper structural levels between $0.55 and $0.50. These zones are historically significant and could determine whether Cardano’s current downtrend deepens or stabilizes.

Investors are closely monitoring:

- Global economic data showing slowing trade activity

- Geopolitical developments easing volatility across major assets

- ADA’s ability to form a base above $0.55 in the coming sessions

Conclusion: ADA Bears in Control Unless $0.585 is Reclaimed

Unless ADA reclaims and holds above $0.582–$0.585, the outlook remains bearish. The current structure favors continued downside movement unless broader market sentiment improves significantly.

With volume rising during failed rallies, traders should remain cautious of bull traps and instead look for confirmation at stronger support zones before considering long positions.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.