The first-ever Solana staking ETF in the US is now on the verge of launch, according to top ETF analysts closely tracking the regulatory process. The ETF, proposed by provider REX Shares, is generating buzz in the crypto industry after updated filings suggest that all regulatory hurdles may have been cleared.

SEC Comfortable with Solana ETF Structure

Analysts note that the U.S. Securities and Exchange Commission (SEC) appears to be on board with REX Shares’ unique approach. Instead of using the standard 19b-4 filing process required for most crypto-related ETFs, REX opted for an alternative method under the ’40 Act, utilizing a rare c-corp business structure. This has allowed the fund to bypass regulatory bottlenecks that have delayed other crypto staking ETFs.

“Looks like they’re comfortable pushing forward,” said one ETF expert, referring to the SEC’s response.

Previously, the SEC had raised concerns about this structure under the 6C-11 ETF rule, but those appear to have been addressed.

ETF Analysts Say Launch Is Imminent

Following the updated filing, analysts now say “all systems are go” for the fund’s launch. The revised prospectus shows that SEC feedback has been incorporated, removing remaining roadblocks.

“They are good to launch—it looks like,” said a senior ETF analyst, citing a recent email exchange with regulatory insiders.

REX Shares also issued a statement confirming that the “first-ever staked crypto ETF” in the U.S. is arriving soon.

A Milestone for Crypto ETFs and Solana

This ETF is a major step forward for Solana (SOL) and for the broader crypto ETF market. It will not only track the price of Solana, but also offer onchain staking yield, marking a new era of yield-generating crypto exposure.

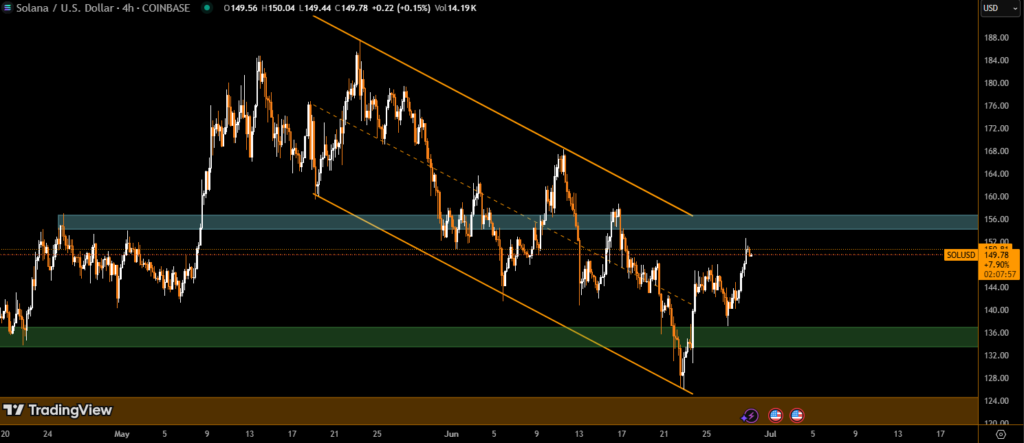

As of now, Solana price stands at $149.63, and speculation is growing that ETF-related momentum could push it towards the $200 mark. Meanwhile, Solana futures open interest has already hit $7.4 billion, signaling strong market anticipation.

What This Means for Investors

The approval and launch of a Solana staking ETF could unlock institutional access to yield-generating crypto products for the first time. With Ethereum ETFs already considered successful, the addition of staking features may be a game-changer for mainstream adoption.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.