XRP trading volume dropped sharply by 54% in the last 24 hours, raising concerns among investors and traders about the token’s short-term momentum. According to the latest data from CoinMarketCap, XRP’s daily volume declined to $1.38 billion, even as the price showed minor gains.

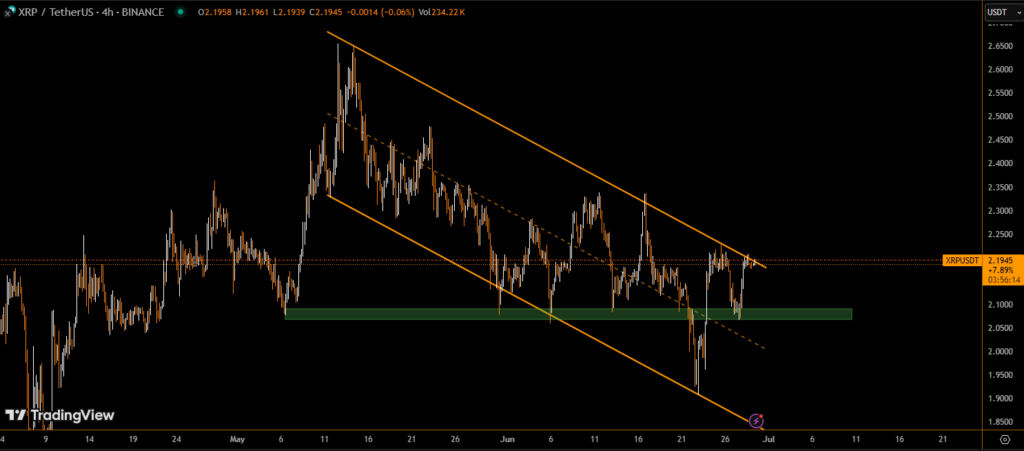

XRP H4 price chart

XRP Volume Drops Despite Bullish Fundamentals

The dramatic decline in volume comes after what many viewed as a milestone week for XRP and the XRP Ledger (XRPL). Among the major developments:

- Ripple dropped its cross-appeal in the SEC lawsuit, signaling potential closure of a years-long legal battle.

- Robinhood launched micro futures trading for XRP, expanding access to derivatives.

- The XRP Ledger released version 2.5.0, introducing key upgrades like Permissioned DEX, TokenEscrow, and Batch Transactions (XLS-56d).

- Ripple also announced a partnership with Wormhole to enable multichain interoperability, including on its upcoming XRPL EVM sidechain.

Despite these bullish catalysts, XRP’s price action and volume show signs of market fatigue.

Market Caution and Technical Resistance May Be Holding XRP Back

At the time of writing, XRP trades at $2.19, up only 0.33% in the past 24 hours. This tepid price action suggests that many investors are waiting for a clear technical breakout before re-entering the market.

Key resistance levels to watch:

- $2.25 – the 50-day moving average

- $2.36 – the 200-day moving average

- A breakout above these could open the path to $2.65, a level that aligns with prior bullish targets.

The sharp decline in trading volume indicates that liquidity may be drying up, at least temporarily, as traders reassess short-term risks.

XRP Ledger Developments Set Long-Term Bullish Tone

The recent release of rippled v2.5.0 marks a significant step forward in XRPL functionality. Notable additions include:

- Permissioned DEX for KYC-compliant trading

- Squelching algorithms to improve network efficiency

- Batch transaction support, enabling developers to bundle actions

- Permission delegation, which enhances token issuer control and security

These upgrades reinforce XRPL’s position as a scalable, enterprise-grade blockchain, even if short-term volume is cooling.

XRP Faces a Wait-and-See Period

Although XRP price is holding steady, the sharp drop in volume points to a market-wide pause. Investors appear to be waiting for a breakout or fresh macro drivers before making major moves.

With strong fundamentals and growing institutional support, XRP’s long-term outlook remains bullish, but the next few days will be key to determining if momentum can return.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.