Stablecoin Giant Seeks Federal Oversight for USDC Operations

Circle, the issuer of the second-largest stablecoin USDC, has officially applied for a national trust bank charter in the United States. If approved by the Office of the Comptroller of the Currency (OCC), the newly proposed First National Digital Currency Bank would allow Circle to manage USDC reserves under federal regulation while offering digital asset custody services to institutional clients.

Key Benefits of a National Trust Bank Charter

- Direct oversight by the OCC, eliminating the need for state-by-state money transmitter licenses.

- Enhanced regulatory compliance, aligning with the proposed GENIUS Act (passed by the Senate in June).

- Ability to custody digital assets for institutional investors.

- No deposit-taking or lending—strictly focused on stablecoin issuance and custody.

Why Circle is Pursuing a Bank Charter

Circle CEO Jeremy Allaire stated that the move is a proactive step to strengthen USDC’s infrastructure and comply with emerging stablecoin regulations. The application follows years of deliberation—Circle has reportedly considered a bank charter since 2022.

The Approval Process & Timeline

- 30-day public comment period before OCC review.

- Final decision expected within 120 days of a complete application.

- If approved, Circle would join Anchorage Digital Bank (licensed in 2021) as one of the few crypto-native federally chartered banks.

Growing Trend: Crypto Firms Seek Bank Licenses

Circle isn’t alone—Fidelity’s digital currency division and other crypto companies are also reportedly exploring national bank charters. This trend highlights the industry’s push for regulatory clarity and institutional adoption.

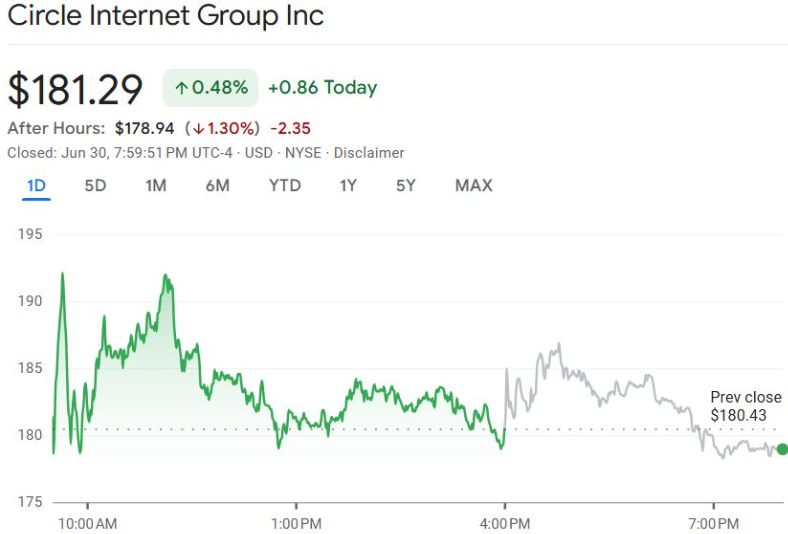

Market Reaction & Circle’s Stock Performance

- USDC remains pegged at $1, with a market cap of $32 billion.

- Circle’s stock (CRCL) traded flat, closing at $181 (up 0.48%) before dipping 1.3% in after-hours trading.

- The stock had a strong debut in June, surging 167% on its first trading day.

What’s Next for Circle and USDC?

If approved, Circle’s federal charter could:

Increase trust in USDC as a regulated stablecoin.

Streamline compliance across all 50 states.

Pave the way for more crypto firms to seek bank charters.

With stablecoin regulations advancing in Congress, 2024 could be a pivotal year for USDC and the broader crypto banking sector.

Will the OCC approve Circle’s application? The decision could set a major precedent for crypto’s future in traditional finance.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.