Figma Invests in Bitcoin ETFs Ahead of NYSE IPO

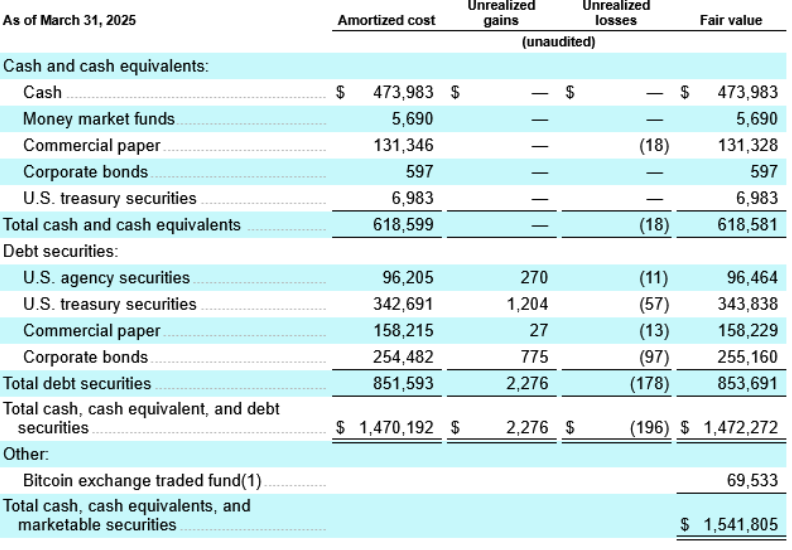

Design software giant Figma has revealed a significant crypto investment strategy in its recent filing with the U.S. Securities and Exchange Commission (SEC). As the company prepares to go public on the New York Stock Exchange (NYSE) under the ticker “FIG”, it disclosed $69.5 million worth of Bitcoin ETFs on its balance sheet.

Figma’s IPO filing highlights the growing trend of tech companies holding Bitcoin as part of their corporate treasury reserves.

The firm invested $55 million into the Bitwise Bitcoin ETF (BITB) on March 3, 2024. As of March 31, the ETF position appreciated to $69.5 million, representing an unrealized profit of 26%.

$30 Million in Stablecoins Set Aside for Future Bitcoin Purchases

In addition to the ETF position, Figma also confirmed that it holds $30 million in USDC (USD Coin), a leading stablecoin pegged to the U.S. dollar.

“The Company intends to re-invest its stablecoin holdings into Bitcoin at a later date,” the filing states.

On May 8, 2025, Figma’s Board of Directors approved the $30M Bitcoin investment strategy, reinforcing a long-term vision for digital asset integration.

This move signals confidence in Bitcoin’s long-term value proposition, as more companies seek to balance traditional cash holdings with crypto exposure.

Industry Leaders Applaud Figma’s Strategic Crypto Move

Bitwise CEO Hunter Horsley praised the decision, stating that Figma is among a growing number of corporations allocating Bitcoin as a treasury asset. He noted that the 5% BTC allocation is a sign of maturing institutional adoption.

Failed Adobe Acquisition and $1B Termination Fee

Figma’s rise comes after the failed $20 billion acquisition by Adobe in 2022. Regulatory hurdles from the UK and EU competition authorities caused the deal to collapse, and Adobe paid a $1 billion reverse termination fee to Figma in December 2023.

Corporations Increasing Crypto Reserves in 2025

Figma joins an expanding list of companies adding crypto to their balance sheets. Recent disclosures include:

- Strategy (formerly MicroStrategy): Added $531 million in Bitcoin, now holding 597,000 BTC.

- Metaplanet (Japan): Acquired 1,005 BTC for $108 million.

- BitMine Immersion Technologies: Raised $250 million to begin building an Ethereum treasury reserve.

Figma’s Bitcoin ETF holdings reflect a growing corporate trend — using digital assets as a strategic hedge against inflation and a foundation for long-term value.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.