SOL Drops Nearly 8% Despite Positive Institutional Milestone

Solana (SOL) fell sharply by 7.84% over the past 24 hours, dropping from $157.42 to $145.08 as of July 1, despite growing anticipation around the launch of the REX-Osprey SOL + Staking ETF. This marked underperformance comes even as broader crypto market benchmarks remained relatively stable.

The price decline underscores cautious sentiment, with traders selling into strength ahead of the ETF’s official debut.

REX-Osprey SOL + Staking ETF Launches July 2

Set to debut under the ticker SSK on July 2, 2025, the REX-Osprey SOL + Staking ETF is the first U.S.-listed ETF to provide both price exposure and staking yield for Solana. Structured under the 1940 Investment Company Act, the fund offers enhanced investor protections and regulatory clarity.

- 80% of the ETF’s assets will be allocated to SOL

- Approximately 50% of those tokens will be staked, generating passive income for shareholders

This launch is considered a significant leap forward for Solana’s institutional appeal, offering a more complete asset exposure model than traditional spot-tracking ETFs.

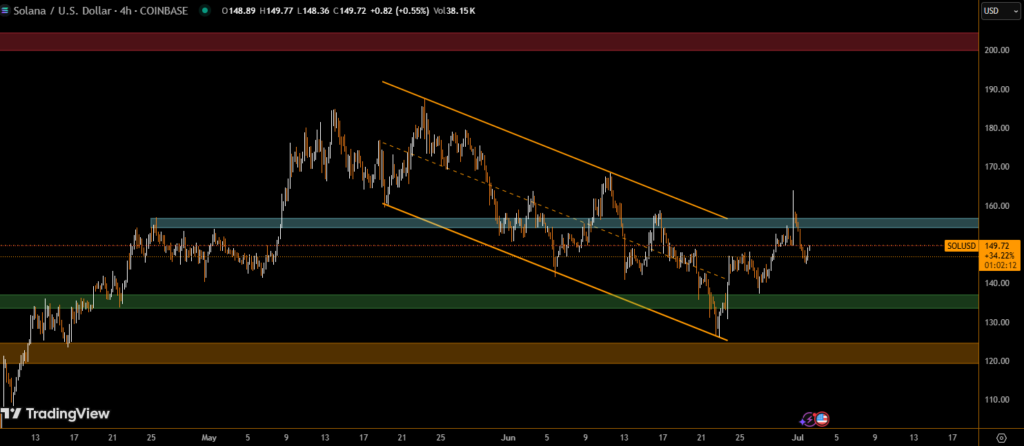

Technical Analysis: Selling Pressure Overwhelms Pre-ETF Optimism

Despite positive fundamentals, SOL’s price action revealed strong bearish momentum:

- SOL dropped $12.34 within 24 hours, with a price range spanning $157.42 to $145.08

- Heavy resistance was seen at $157.42 early in the session

- The largest sell volume occurred at 06:00 UTC, exceeding 1.57 million tokens, with price rejection near $151.50

- Support emerged at $146.55 during the 14:00 UTC hour, paired with increased volume suggesting accumulation interest

- In the final trading hour, SOL declined further to its intraday low of $145.08, maintaining a descending channel pattern

Price continues to form lower highs and lower lows, indicating sustained bearish pressure despite institutional news.

Short-Term Weakness, Long-Term Opportunity

While SOL is underperforming in the short term, the imminent launch of a U.S.-regulated staking ETF signals growing confidence from institutional players.

If support near $146 holds, the ETF debut could trigger renewed bullish sentiment — especially if volume confirms buying strength.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.