Regulatory Clarity in EU Spurs Major Crypto Exchange Launches

Two leading global crypto exchanges, Bybit and OKX, have officially launched MiCA-compliant platforms in the European Union, signaling a pivotal shift in the continent’s crypto landscape. These expansions come as Europe implements the Markets in Crypto-Assets Regulation (MiCA)—a unified regulatory framework now attracting major players across the digital asset industry.

MiCA: Europe’s Crypto Game-Changer

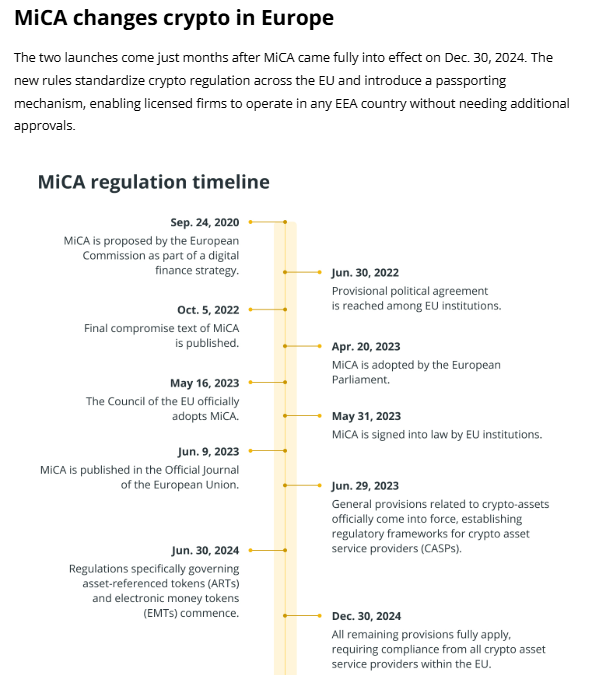

The MiCA regulation, fully enforced as of December 30, 2024, introduces standardized rules for crypto firms across the European Economic Area (EEA). A key component is the passporting mechanism, allowing any MiCA-licensed firm to operate in all 29 EEA member countries without needing country-by-country approval.

This clarity and efficiency have made Europe a hotbed for crypto growth, overtaking regulatory rivals like the UK and even the U.S. in some areas, according to industry leaders.

Bybit Launches Austria-Based Platform for the EU

On Wednesday, Bybit announced the launch of its new EU platform under the domain Bybit.eu. The company secured a Crypto-Asset Service Provider (CASP) license based in Austria, granting it MiCA approval for operations throughout the entire EEA.

Key features of Bybit.eu include:

- Multi-lingual support: English, Polish, Portuguese, and Spanish available now, with German, French, Italian, and Romanian coming soon.

- Aggregated liquidity from multiple providers for enhanced market depth.

- Advanced trading tools designed for both retail and institutional users across Europe.

OKX Launches Regulated Exchange in France

Rival exchange OKX also announced on the same day its full MiCA-compliant launch in France, one of the most crypto-forward countries in the bloc. OKX obtained regulatory approval through MiCA passporting and plans to scale throughout Europe from its French base.

OKX Europe CEO Erald Ghoos called the France launch a “major milestone”, citing it as a key market in OKX’s European strategy.

The French OKX platform offers:

- Euro-denominated trading pairs

- Staking products

- Trading bots

- Localized customer support

A Competitive Race in the EEA

With Kraken, Bitvavo, Paxos, and Coinbase all recently securing MiCA licenses, the European crypto sector is now more competitive—and more regulated—than ever before.

Paxos launched its Global Dollar (USDG) stablecoin on Tuesday, while Bitvavo became the latest exchange to receive MiCA licensing from the Dutch Authority for Financial Markets.

Paybis co-founder Konstantins Vasilenko noted that EU trading volumes surged 70% in Q1 2025 despite stable user numbers, suggesting larger, more institutional capital is entering Europe thanks to MiCA.

MiCA Is Turning Europe Into a Crypto Leader

As MiCA reshapes the regulatory environment, Europe is becoming a global crypto stronghold. With Bybit, OKX, and other major exchanges joining the EU marketplace, users can now access safer, more transparent crypto services under a unified legal framework.

This regulatory clarity is proving to be a magnet for both retail users and institutional investors, pushing Europe to the frontlines of global crypto adoption.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.