BONK, a popular meme coin built on Solana, rallied close to 10% on July 2 after Tuttle Capital Management filed a key amendment indicating its 2x Leveraged BONK ETF could launch as early as July 16, 2025. While the ETF is still pending regulatory approval, the filing has reignited investor interest in structured meme coin products.

BONK Rallies on ETF News, Hits $0.00001524 Before Retracing

BONK surged from $0.0000136 to a high of $0.00001524, before settling at $0.00001494, representing a 9.87% daily gain. The rally was fueled by Tuttle Capital’s post-effective amendment to the U.S. SEC, setting July 16 as the earliest possible launch date for its proposed 2x Long BONK ETF.

This ETF, if approved, would be the first leveraged BONK product to trade on traditional financial platforms.

The filing also includes similar 2x products for other tokens like SOL, TRUMP, MELANIA, XRP, ADA, and LTC, marking an effort to bridge the meme and altcoin sectors with regulated financial exposure.

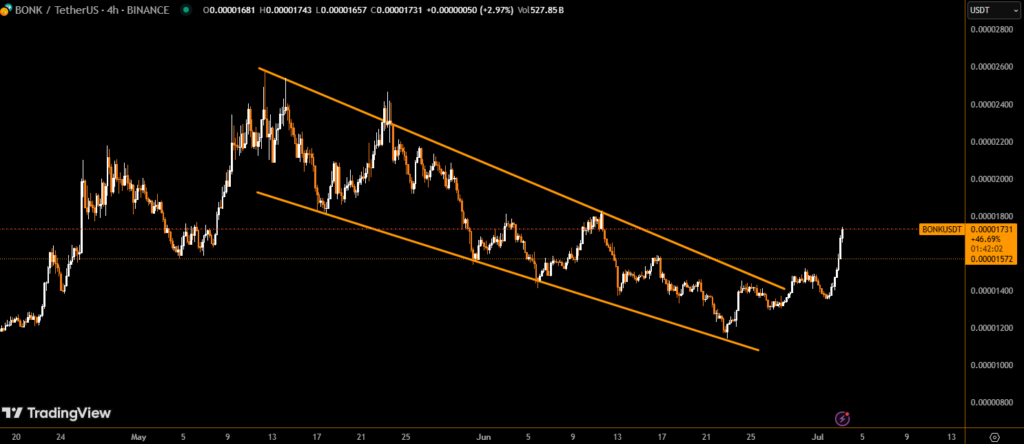

Technical Analysis: Caution After Bullish Spike

The BONK/USDT chart shows that after the breakout above $0.0000144 — confirmed by 1.38 trillion in trading volume during the 16:00 UTC hour — the price formed a head-and-shoulders pattern, signaling a potential short-term reversal.

- A sharp sell-off below $0.00001500 was recorded at 17:39 UTC with 73.9 billion volume, indicating potential exhaustion.

- Support is now seen at $0.0000142, reinforced by high-volume accumulation around the 13:00 hour.

- Volatility remains elevated, suggesting further short-term speculation as ETF discussions evolve.

BONK DAO and Solana Ecosystem Update

Meanwhile, BONK developers confirmed that the Saga phone token redemption program will end on July 31. Of the original 20,000 BONK token allocations, 17,599 have been claimed, with the remaining set to return to the BONK DAO for future ecosystem growth.

Solana’s ecosystem is also expanding. DeFi Development Corp recently joined as a validator, helping to enhance decentralization and solidifying Solana’s foundation for meme tokens and broader Web3 adoption.

The Solana network now features over 350 on-chain integrations, increasing the utility of BONK and similar assets in DeFi and beyond.

Key Takeaways:

- BONK jumped 9.87% to $0.00001494 following leveraged ETF filing news.

- Tuttle Capital’s ETF could launch as early as July 16, pending SEC approval.

- Technical indicators warn of a potential pullback after a head-and-shoulders pattern.

- BONK DAO initiatives and Solana’s growth continue to support long-term value.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.