As publicly traded companies increasingly add crypto to their balance sheets, analysts at Franklin Templeton Digital Assets have issued a strong caution: the corporate crypto treasury model carries serious systemic risk if not managed carefully.

The Rise of Corporate Crypto Treasuries

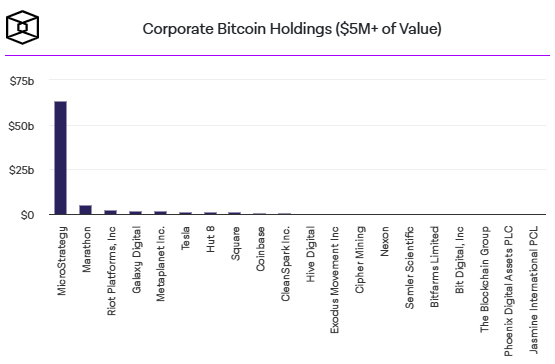

Inspired by Strategy (formerly MicroStrategy), more than 135 public firms now hold Bitcoin (BTC) as part of their core treasury strategy, according to data from Bitcoin Treasuries. Others like Metaplanet, Twenty One, SharpLink, and Sol Strategies are following suit with Ethereum (ETH) and Solana (SOL) as well.

These companies raise capital through various instruments — convertible notes, preferred shares, equity sales, and SPACs — and use the funds to acquire crypto assets in hopes of asset appreciation and staking income.

Volatility: A Double-Edged Sword

While crypto volatility is traditionally viewed as a liability, Franklin Templeton argues it’s actually an enabler of this strategy. Volatile markets increase the value of embedded options in convertible instruments, and rising crypto prices often boost a company’s market capitalization, reinforcing investor interest.

“The ability to raise capital at a premium to NAV is a major advantage,” the analysts noted.

Proof-of-Stake assets like ETH and SOL also allow for staking rewards, offering companies a passive income stream alongside appreciation.

The Dangerous Feedback Loop

However, the upside is not without risks. A negative feedback loop could devastate companies using this strategy:

- If the market-to-NAV ratio drops below 1, firms cannot issue accretive equity.

- In bearish conditions, they may be forced to sell assets to support their stock price.

- This selling pressure could further depress crypto prices, compounding losses and shaking investor confidence.

“This self-reinforcing spiral could halt capital formation and trigger major sell-offs,” Franklin Templeton warned.

A High-Risk, High-Reward Model

The crypto treasury model marks a new chapter in institutional adoption, but analysts emphasize that its success hinges on maintaining investor optimism and avoiding liquidity crunches during downturns.

“These are highly risky plays, especially in prolonged bear markets,” the report concluded.

Institutional Voices Echo Concerns

Earlier, Coinbase Institutional’s head of research, David Duong, noted that leveraged crypto holdings could eventually present systemic risks, though such pressure is “limited in the short term.”

Analysts at Presto Research also agreed the risk of collapse is real — but more nuanced than the 2022 crypto crises like Terra and 3AC.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.