China’s tech giants JD.com and Ant Group are intensifying efforts to launch yuan-based stablecoins, aiming to boost the Chinese currency’s role in international trade and reduce dependence on U.S. dollar-pegged tokens.

Stablecoin Lobbying Intensifies in China

According to a Reuters report, JD.com and Ant Group have privately urged the People’s Bank of China (PBOC) to approve yuan-backed stablecoins. These coins, pegged to offshore yuan, would initially launch in Hong Kong and later expand to China’s free trade zones, offering a controlled yet international deployment.

Executives from JD.com reportedly called yuan stablecoins “urgently needed” to support the international use of the renminbi.

Both companies are also preparing to apply for stablecoin licenses in Hong Kong and Singapore, aligning with regional efforts to lead in digital asset innovation.

US Dollar Still Dominates Global Payments

The push comes as the Chinese yuan’s global payment share fell to 2.89% in May 2025, the lowest in two years. In contrast, the U.S. dollar maintains a dominant 48% share, according to SWIFT data.

Industry veteran Wang Yongli, former deputy head of the Bank of China, warned that if yuan cross-border payments remain inefficient, China risks falling further behind dollar-denominated digital assets.

“Dollar stablecoins are rapidly becoming the default digital settlement layer,” said one source familiar with the matter.

Hong Kong’s Digital Asset Framework Sets the Stage

Hong Kong recently unveiled its “LEAP” initiative, a regulatory framework designed to encourage stablecoin innovation, asset tokenization, and legal clarity. Starting August 1, a licensing regime for stablecoin issuers will be in place, positioning Hong Kong as a launchpad for yuan-denominated digital currencies.

JD.com’s founder Liu Qiangdong confirmed plans to apply for stablecoin licenses across major global jurisdictions, signaling a bold move to make yuan-backed tokens part of the global payment infrastructure.

A Multipolar Currency System Ahead?

The PBOC’s vision is to build a “multipolar” global currency framework, where no single currency dominates. The launch of yuan-backed stablecoins could serve as a key step toward internationalizing the digital yuan, supporting China’s long-term goal of reducing reliance on the dollar.

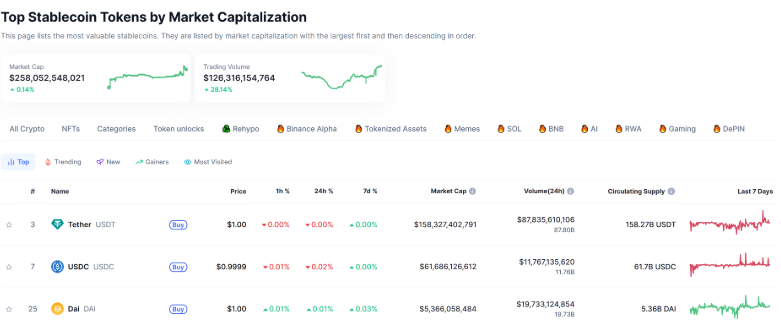

Currently, all top 10 stablecoins by market cap are U.S. dollar-denominated. The euro-pegged EURC ranks 11th, showing the immense gap other currencies must bridge.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.