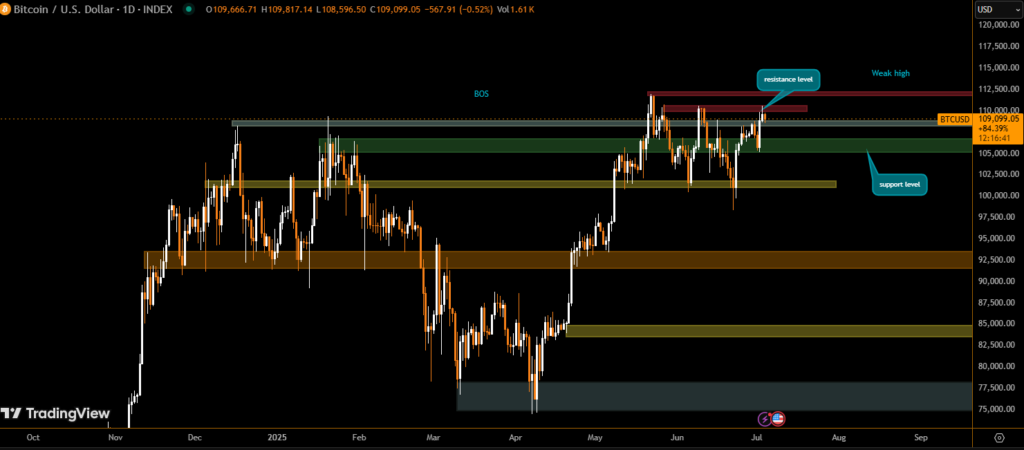

Bitcoin (BTC) is trading just 3% below its record high as macroeconomic tailwinds and seasonal trends converge, setting the stage for what could be a historic July breakout.

Wall Street Momentum Fuels Crypto Optimism

Traditional U.S. equity markets are surging. The S&P 500, Nasdaq, and Dow Jones Industrial Average have all reached fresh all-time highs. As institutional confidence strengthens, excess capital often finds its way into alternative assets, with Bitcoin at the forefront.

Currently priced around $109,000, Bitcoin is less than $3,000 away from the all-time high it briefly touched in May 2025.

Liquidity Surge and Fiscal Pressure Boost BTC’s Store-of-Value Appeal

One of the major drivers behind this momentum is the exploding U.S. money supply. The M2 money supply has reached an unprecedented $21.9 trillion, rising steadily for over a year. This liquidity flood is increasing demand for scarce, inflation-resistant assets like Bitcoin.

Meanwhile, America’s fiscal policy is under scrutiny. According to billionaire investor Ray Dalio, President Trump’s new “Big Beautiful Bill” locks in $7 trillion in annual spending against just $5 trillion in revenue.

“If the deficit remains around 7% of GDP instead of falling to 3%, the U.S. could face ‘big, painful disruptions,’” Dalio warned.

Projected debt levels could rise from 100% of GDP to 130% over the next decade—conditions that historically benefit non-sovereign assets like BTC.

Seasonal Tailwinds: July Is Historically Bullish for Bitcoin

July is typically a strong month for Bitcoin, with historical data showing an average monthly gain of 7%. This seasonal bullishness is compounding positive sentiment, encouraging both retail and institutional investors to re-enter the market.

Bitcoin’s upward momentum is backed by favorable technicals, macro liquidity, fiscal concerns, and a strong seasonal bias.

Record Highs in Sight

With liquidity increasing, fiscal risks rising, and Wall Street setting new records, Bitcoin is on the verge of reclaiming all-time highs. If current momentum continues, BTC could breach $112,000 or more within July, triggering a fresh wave of institutional inflows and media attention.

For crypto investors and traders, the coming weeks may offer a pivotal opportunity—not just for price action, but for validating Bitcoin’s evolving role as a global hedge in a rapidly shifting financial world.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.