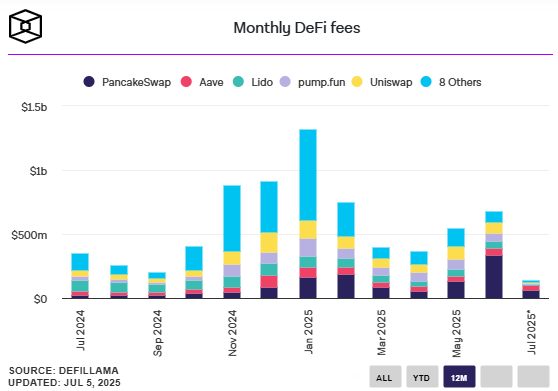

Decentralized Finance Activity Rebounds with $577 Million in Monthly Fees

The decentralized finance (DeFi) sector is experiencing a strong resurgence in 2025. Monthly DeFi protocol fees have soared to approximately $577 million, marking a sharp 58% increase from the April low of $366 million. This jump underscores a renewed investor appetite for onchain financial services and decentralized trading platforms.

This surge reflects growing user trust in DeFi protocols as reliable financial alternatives. The increase also points to higher transaction volumes, expanding protocol usage, and the maturation of DeFi ecosystems that have weathered multiple market cycles.

PancakeSwap Emerges as Top Fee Generator

PancakeSwap has become a standout performer, accumulating $275 million in total fees through its automated market-making services, yield farming, and lottery-based mechanisms. With trading fees ranging from 0.17% to 0.25% per swap, the platform has established itself as a dominant force in the DeFi space.

By enabling peer-to-peer trades without intermediaries, PancakeSwap and similar protocols provide lower-cost, more transparent alternatives to traditional financial services.

Pump.fun Capitalizes on Memecoin Frenzy

Pump.fun’s rise on the fee leaderboards reflects the explosion in memecoin trading. While individual transactions tend to be small, high transaction frequency has helped drive substantial protocol revenue. This model demonstrates how low-value but high-volume activity can still yield significant fee generation when built on efficient smart contract platforms.

Evolution of DeFi Business Models Across Protocols

DeFi platforms have developed diverse revenue streams that span:

- Trading fees (e.g., Uniswap’s 0.3% swap fee shared with liquidity providers)

- Lending and borrowing fees from protocols like Aave and MakerDAO

- Liquidation penalties and staking commissions

These models support long-term sustainability while enabling users to interact with decentralized systems at a fraction of traditional finance’s cost.

Decentralized Models Signal Long-Term Monetization Shift

The current surge in DeFi protocol fees highlights a critical shift. Protocols are finding ways to monetize sustainably without relying on centralized intermediaries. This growing independence aligns with the core ethos of DeFi: transparent, open-access finance controlled by smart contracts and governed by communities.

Conclusion

The recent surge in DeFi protocol fees to $577 million in 2025 demonstrates a strong return of user activity and developer innovation. With PancakeSwap and Pump.fun leading the charge, decentralized financial systems are regaining momentum, suggesting a bullish outlook for the broader crypto ecosystem.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.