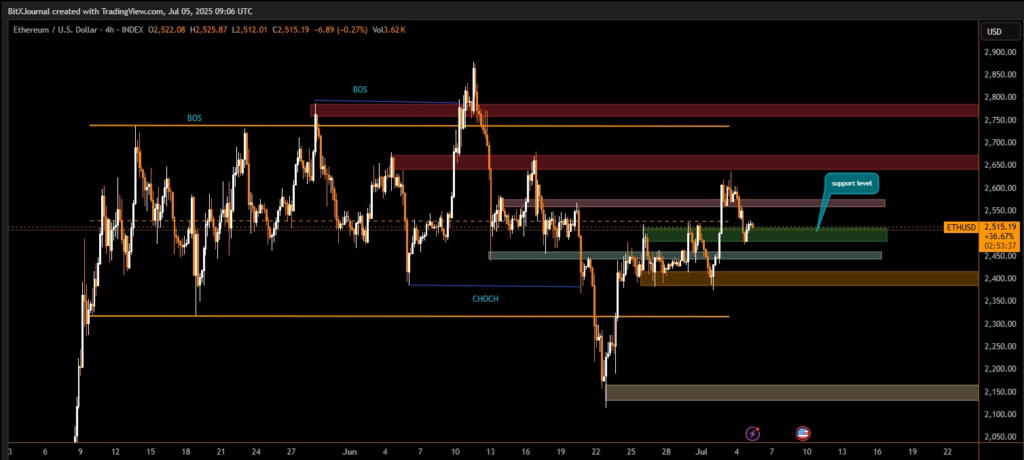

Ethereum (ETH) is currently trading around $2,505, reflecting a 0.56% increase in the past 24 hours. The digital asset has maintained strong support at $2,500, demonstrating market confidence amid a broader uptrend that began in late June. Technical data shows a bullish breakout on July 4, with price briefly touching $2,530, followed by healthy consolidation near $2,515, suggesting stabilized momentum in the short term.

SharpLink adopts Ethereum as core treasury asset

In a significant move for corporate finance, SharpLink Gaming Inc., a Nasdaq-listed performance marketing company specializing in sports betting and iGaming, announced a bold strategic shift. On July 4, 2025, the company became the first public firm to adopt Ethereum as its primary treasury reserve asset. SharpLink confirmed that its entire treasury is deployed across Ethereum-native protocols, including staking and yield-generating strategies.

The company has acquired nearly 198,478 ETH, worth over $500 million, and has already earned more than 220 ETH in staking rewards. The purchases were supported by a $425 million private placement, led by major blockchain players, and further equity raises through ATM offerings.

Institutional backing reinforces Ethereum’s role in finance

SharpLink’s strategy signals a broader institutional shift toward decentralized finance. The firm emphasized Ethereum’s unique benefits as a reserve asset: it is productive, scarce, secure, and interoperable with DeFi protocols. Joseph Lubin, Ethereum co-founder, has joined SharpLink’s Board as Chairman, reinforcing the alignment between the company and Ethereum’s long-term vision.

CEO Rob Phythian noted that SharpLink’s Nasdaq closing bell ceremony on July 7 will mark a symbolic moment in integrating blockchain into traditional finance.

Technical outlook for Ethereum

From July 4 to July 5, ETH gained 2.2%, rebounding from $2,475 to $2,530. A sharp sell-off was quickly absorbed, with strong buyer interest near the $2,500 level. Over 382,000 ETH changed hands in one hour during this support test, reflecting high liquidity and active market participation.

Reduced volatility, coupled with a rising trendline, suggests Ethereum’s price may gradually build toward new resistance levels, provided the broader market remains constructive.

Conclusion

Ethereum’s growing use as a corporate treasury asset reflects its emerging status as the foundational layer of global finance. With institutional adoption accelerating and staking rewards adding to its utility, Ethereum continues to position itself at the center of digital value creation.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss