Bitcoin Volatility Reaches Historic Lows

Bitcoin is entering the second half of 2025 with a surprising trend: its implied volatility has dropped to the lowest level in 20 months. Current volatility metrics mirror conditions last seen in October 2023, when the asset was trading between $28,000 and $35,000. This marks a significant contrast to Bitcoin’s present price zone, which is now nearly three times higher.

The “at-the-market” implied volatility, a measure tracking expected price swings from one week to six months, has steadily declined. This reduced volatility reflects calmer price behavior and tighter trading ranges, signaling that speculative activity may be cooling — or entering a consolidation phase.

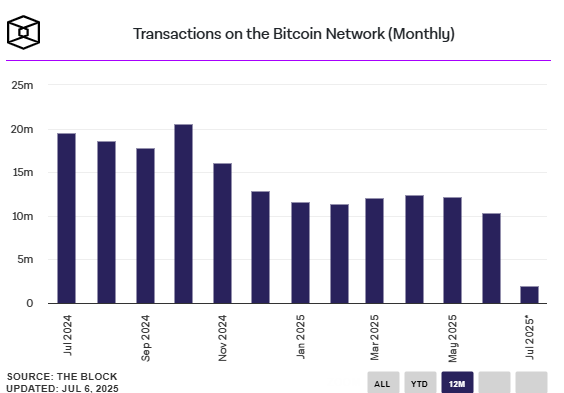

Bitcoin Network Activity Declines

In parallel with the drop in volatility, Bitcoin’s monthly transaction count has also declined. June 2025 recorded the lowest number of on-chain Bitcoin transactions since October 2023, falling by 15% compared to May.

Some blocks are now being filled with ultra-low fee transactions, indicating diminished user urgency and lower network congestion. These trends suggest a slowdown in retail or small-scale activity on the Bitcoin blockchain.

ETF Inflows Hit Record Levels

Despite reduced on-chain movement, institutional interest remains robust. U.S.-based spot Bitcoin ETFs have now approached $50 billion in cumulative net inflows, setting a new record. In just two days last week, these funds saw over $1 billion in fresh investments, underlining sustained demand from large-scale investors.

Combined, these ETFs now hold approximately $137.6 billion worth of BTC, an all-time high for the sector. The growth highlights a clear decoupling between traditional financial investment flows and on-chain usage metrics.

Institutions Continue Buying

In addition to ETFs, publicly listed companies acquired roughly 65,000 BTC in June alone, representing over $7 billion at current market prices. This shift points to a rising dominance of high-net-worth and institutional participants on the network, while individual user engagement slows.

Conclusion

Bitcoin’s ecosystem is experiencing a unique phase of low volatility and reduced on-chain activity, even as institutional adoption accelerates through ETFs and corporate purchases. This divergence suggests a maturing market, where long-term holders and financial institutions play an increasingly central role — possibly reshaping how Bitcoin functions as both a speculative asset and a store of value.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss