Despite ongoing macroeconomic uncertainties and tighter funding conditions, venture capital in the crypto sector remains active, with investors backing innovation in DeFi, AI, tokenization, and hybrid exchanges. Recent funding rounds signal a clear focus on infrastructure, decentralized intelligence, and real-world asset integration.

Hybrid Exchange Rails Secures $20M to Bridge CEX and DEX Models

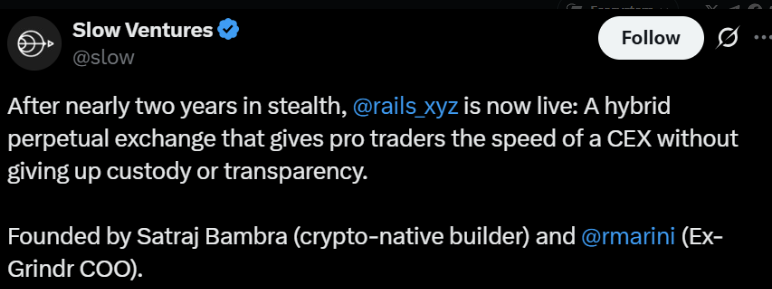

Rails, a next-generation hybrid exchange, has gone live following $20 million in venture funding across two rounds. Backed by major names including Kraken, Quantstamp, and Slow Ventures, the platform aims to deliver the speed of centralized trading without compromising asset custody—a key benefit of decentralized exchanges.

The project positions itself as a perpetual hybrid exchange catering to professional traders seeking performance without counterparty risk.

Beam Raises $7M to Expand Stablecoin Payments

Beam, a stablecoin-based payment infrastructure provider, closed a $7 million funding round led by Castle Ventures. With integrations into Visa Direct, Mastercard Send, and the FedNow system, Beam aims to scale its operations across Latin America, Africa, Asia-Pacific, and the EU. The platform’s focus is on bridging fintech and traditional banking systems through compliant stablecoin rails.

Frachtis Launches $20M Fund for Crypto-AI Projects

Frachtis, a new crypto-native venture fund, announced a $20 million pre-seed fund aimed at supporting decentralized AI and infrastructure startups. Backed by Theta Capital and RockawayX, the fund has already invested in eight early-stage DeFi and AI protocols, demonstrating strong investor interest in the intersection of blockchain and artificial intelligence.

Inference Labs Raises $6.3M to Build Trust in AI Outputs

Inference Labs secured $6.3 million to build cryptographic trust layers for AI agents using zero-knowledge proofs. Their “Proof of Inference” protocol enables AI results to be validated cryptographically—key for sectors demanding verifiable transparency. Integrations with EigenLayer and Bittensor are already live on testnet, with a mainnet launch expected in Q3 2025.

Gradient Network Gets $10M to Power Decentralized AI on Solana

Gradient Network, developing AI infrastructure on Solana, raised $10 million from Pantera Capital, Multicoin Capital, and others. The funding will support development of Parallax, a decentralized inference engine to scale LLMs and AI models across decentralized environments. Its decision to build on Solana helped attract strategic funding.

OKX and Story Announce $10M Ecosystem Fund for IP on Blockchain

Story, a programmable blockchain for intellectual property (IP), and crypto exchange OKX launched a $10 million innovation fund. The fund will distribute capital via the IP token to support projects focused on AI data licensing, programmable IP, and on-chain IP asset frameworks.

Yupp Raises $33M for AI Output Evaluation on Blockchain

Yupp, a blockchain startup transforming AI model evaluation into an economic activity, raised $33 million in seed funding, led by a16z Crypto. The platform rewards users for comparing AI model outputs across tools like ChatGPT, Claude, and Llama, converting human judgment into a valuable on-chain resource.

Blueprint Finance Adds $9.5M to Expand DeFi Suite

Blueprint Finance raised an additional $9.5 million to build out its multichain DeFi infrastructure. Following the launch of Concrete on Ethereum and Glow Finance on Solana, the company is scaling yield and trading products. Backers include Polychain Capital, BitGo, VanEck, and others.

Units Network Gets $10M to Improve Web3 Scalability

Units Network, operating on the Waves protocol, closed a $10 million round led by Nimbus Capital. The funds will be used to expand validator networks, improve cross-chain liquidity, and accelerate its AI integration roadmap within Web3 infrastructure.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.