Ripple Remains Top Crypto Bet Despite Linqto’s Collapse

The recent bankruptcy filing by Linqto, a secondary share platform that held over 4.7 million Ripple shares, has raised concerns among retail investors. However, leading private investment platform EquityZen has confirmed that Linqto’s financial issues pose no risk to the broader pre-IPO market.

EquityZen’s CEO, Atish Davda, stated that the company has no ties or exposure to Linqto’s operations, assuring clients that their investments remain fully protected. The statement helped ease fears of contagion in a sector that’s seen growing interest amid ongoing IPO anticipation.

What Is the Pre-IPO Market?

The pre-IPO market refers to investments in private company shares before they list publicly. Platforms like EquityZen provide access to shares in major firms like Ripple, SpaceX, and Circle, which are still privately held.

While traditional IPOs occur on public exchanges like Nasdaq, pre-IPO shares offer early access to potential high-growth companies—often with a longer investment horizon and higher reward potential.

Crypto Sector Gains Ground in Private Investment

According to EquityZen’s Q2 2025 report, crypto became the sixth most popular sector for pre-IPO investments, led by interest in stablecoins and blockchain firms. This trend was largely driven by Circle’s successful IPO in June, which renewed investor confidence in the digital asset space.

Ripple ranked among the top 10 most in-demand private companies, competing alongside AI giant Perplexity and space leader SpaceX. Despite being the only crypto company in the top 10, other firms like Tether and Gemini showed significant momentum, with Gemini confirming a confidential IPO filing with the U.S. SEC.

Market Resilience After a Temporary Dip

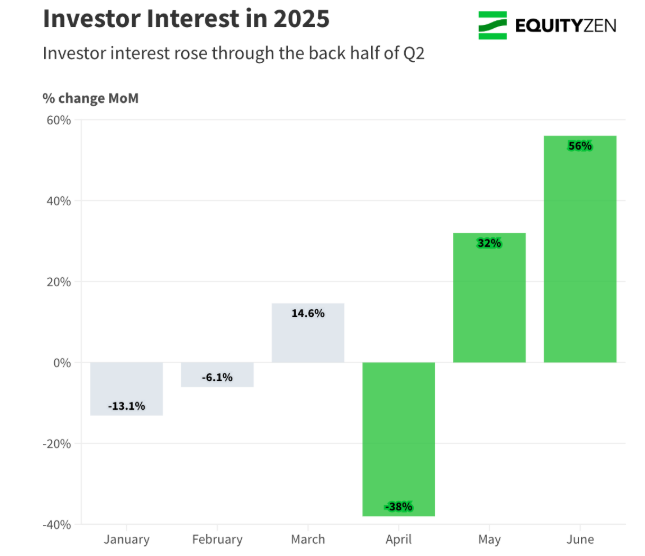

Investor interest in pre-IPO opportunities surged 56% in June, recovering from a 38% decline in April that was triggered by U.S. tariff uncertainties. The bounceback highlights the market’s resilience and growing appetite for early-stage tech investments.

Artificial intelligence, fintech, and space technology remain dominant industries, but the inclusion of crypto in the top ranks shows broadening investor acceptance of digital assets as long-term plays.

Key Takeaway

The collapse of one platform doesn’t reflect the health of an entire market. Linqto’s bankruptcy may mark the end of a single firm, but pre-IPO demand—especially in crypto and AI—remains strong, fueled by regulatory clarity, IPO success stories, and growing institutional interest.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.