Ethereum (ETH) surged to nearly $3,000, marking its highest level in over four months. This rally comes as Bitcoin (BTC) hit new all-time highs above $116,000, lifting overall sentiment in the crypto market. ETH gained 6.7% in the last 24 hours, recovering sharply from previous lows and showing signs of renewed strength.

ETF Inflows and Corporate Demand Fuel Ethereum’s Rally

One of the key drivers behind Ethereum’s recent price surge is the strong demand for U.S.-listed spot ETFs, which have seen over $500 million in inflows this month alone. This institutional interest is helping Ethereum regain investor confidence after underperforming other major assets like Bitcoin and Solana during this cycle.

Additionally, Ethereum is seeing growing adoption in corporate treasury strategies. Companies such as Sharplink Gaming and Bitmine Immersion Technology have added ETH to their balance sheets, signaling broader recognition of Ethereum’s long-term utility.

Tokenization and Settlement Use Cases Strengthen ETH Fundamentals

Ethereum’s rally is also driven by its increasing role in settlement infrastructure and real-world asset tokenization. As global firms look to tokenize assets such as real estate, securities, and collectibles, Ethereum remains the leading blockchain for hosting such activity.

Its smart contract capabilities and robust developer ecosystem make Ethereum a natural choice for tokenization platforms and enterprise solutions.

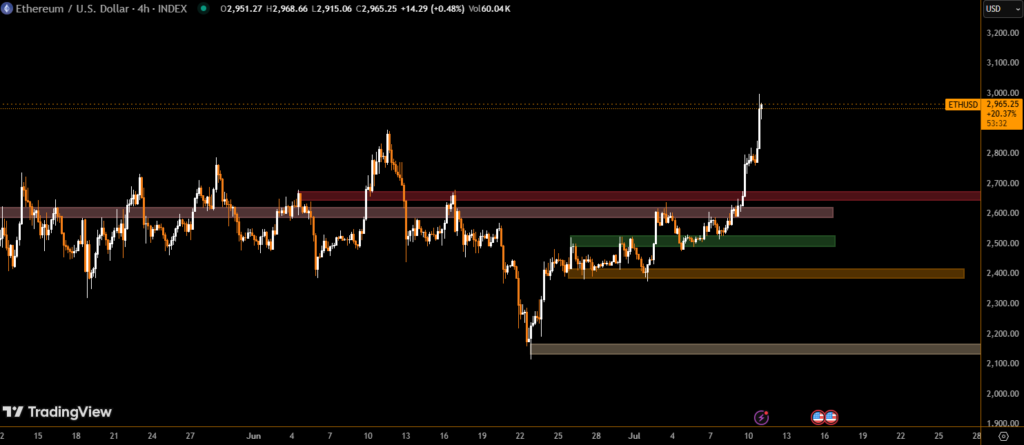

Market Outlook: Resistance at $3,000, Support at $2,750

According to market models, $3,000 is now acting as a key resistance level for ETH. A confirmed breakout above this zone could pave the way for further upside. On the downside, $2,750 has emerged as a critical support level, providing a potential buying zone for investors anticipating long-term gains.

The ETH/BTC ratio is also showing signs of stabilization, indicating that Ethereum may be ready to close the performance gap it has experienced against Bitcoin in recent months.

Ethereum Regains Market Attention

Ethereum’s approach to the $3,000 mark signals a return of momentum, backed by institutional inflows, increased use in tokenization, and expanding corporate adoption. With ETF capital flowing in and Ethereum’s real-world utility gaining visibility, analysts expect continued upward pressure if broader market conditions remain supportive.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.