Ethereum (ETH) crossed a major psychological milestone on July 11, as the price broke above $3,000, fueled by institutional demand, strong ETF inflows, and a rare derivatives market shift. At the time of writing, ETH is trading at $3,012.44, up 8.22% over the past 24 hours, with a session high of $3,024.59.

Between July 10, 09:00 to July 11, 08:00, ETH gained 7.10%, climbing from $2,788.96 to $2,976.10, backed by a volume spike of 1,202,822 units — nearly 4x its 24-hour average. A massive surge occurred at 21:00 UTC, as ETH exploded from $2,819.79 to $2,972.56 in a single session.

Ethereum ETF Demand Outpaces Expectations

The rally is underpinned by rising institutional interest. Since July 7, Ethereum ETFs have attracted over $320 million in inflows, with BlackRock’s ETHA fund leading at a $5.06 billion market cap. On July 9 alone, ETHA saw $206.57 million in net inflows, reinforcing the bullish trend.

ETH Futures Volume Edges Out Bitcoin in Rare Shift

On July 11, derivatives data revealed a significant market shift. ETH futures volume reached $62.10 billion, slightly exceeding Bitcoin’s $61.70 billion. This rare flip in trading volume marks a potential trader migration toward Ethereum as the preferred speculative vehicle amid bullish fundamentals.

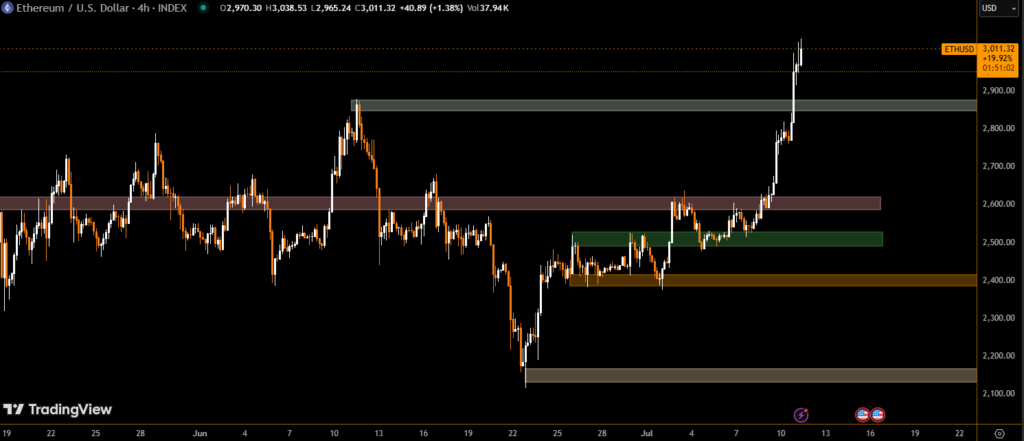

Technical Analysis: Resistance at $3,027, Support at $2,818

Key technical zones emerged:

- Resistance formed at $3,027.83 during early morning hours with 529,411 units in trading volume

- Support held strong near $2,818, signaling continued institutional accumulation

- ETH maintained above $2,950 for much of the session, reflecting bullish consolidation

Zero-Knowledge Tech and Institutional Growth Fuel Momentum

On the fundamental side, the Ethereum Foundation announced integration of zero-knowledge proofs in its Layer 1 stack. The long-term plan includes zkEVM adoption, pipelined execution, and home-compatible proving standards, pushing Ethereum closer to mass scalability and decentralization.

Outlook

Ethereum’s breakout above $3,000 and its futures market dominance signal a significant shift in market dynamics. As institutional demand strengthens and Ethereum evolves toward zk infrastructure, analysts are closely watching if ETH can sustain gains and break past resistance at $3,027 — paving the way toward a potential test of $3,100 and beyond.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.