Asia’s Regulatory Clarity Drives Tokenization Growth

Asia is emerging as the global hub for tokenization, with countries like Japan, Hong Kong, and Dubai attracting significant institutional capital through clear regulatory frameworks. These regions are not only drawing investment but also setting new standards for real-world asset (RWA) adoption.

Western institutions are now establishing Asia-Pacific operations, not just to access capital but to engage in innovation. This shift is being driven by Asia’s strategic policies that offer regulatory clarity, investor protection, and frameworks tailored for digital asset markets.

Japan and Hong Kong: Two Models of Innovation

Japan’s approach to tokenization is structured and institutional-grade. Through the Payment Services Act (PSA), stablecoin issuers can hold up to 50% of reserves in low-risk government securities, increasing confidence in the ecosystem. Major financial institutions like MUFG are leading the way in security token issuance infrastructure.

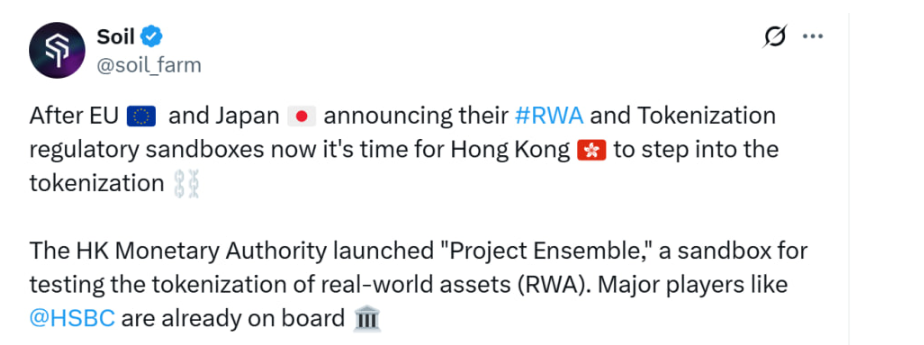

Hong Kong, on the other hand, is focused on regulatory agility. The introduction of the Ensemble Sandbox provides a fast-track route for tokenized product testing and deployment. This balance between long-term depth and rapid innovation is positioning Asia as the leader in blockchain-based finance.

Tokenized Bonds and ETFs Attract Traditional Investors

The rise of tokenized bonds and exchange-traded funds (ETFs) is acting as a bridge between traditional finance and crypto. In Japan, real estate security tokens are outperforming conventional J-REITs by offering direct access, reduced administrative costs, and improved transparency.

This streamlined structure appeals to retail and institutional investors alike, encouraging capital inflow into previously inaccessible asset classes.

Cross-Border Interoperability: The Next Frontier

For tokenization to scale globally, cross-border infrastructure must become seamless and compliant. This means linking systems across nations like Japan and Hong Kong and aligning global frameworks for settlement, custody, and anti-money laundering compliance.

Asia is already taking the lead in this area, creating a blueprint for other regions to follow.

Dubai Joins the Tokenization Race

Dubai is also making headlines by becoming the first in the MENA region to license tokenized real estate projects. In May, two tokenized apartments were sold out within minutes, with buyers from over 35 countries. Remarkably, 70% were first-time property investors, drawn by Dubai’s progressive crypto regulations.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.