Bitcoin Price Climbs to New Highs, Yet Retail FOMO Is Missing

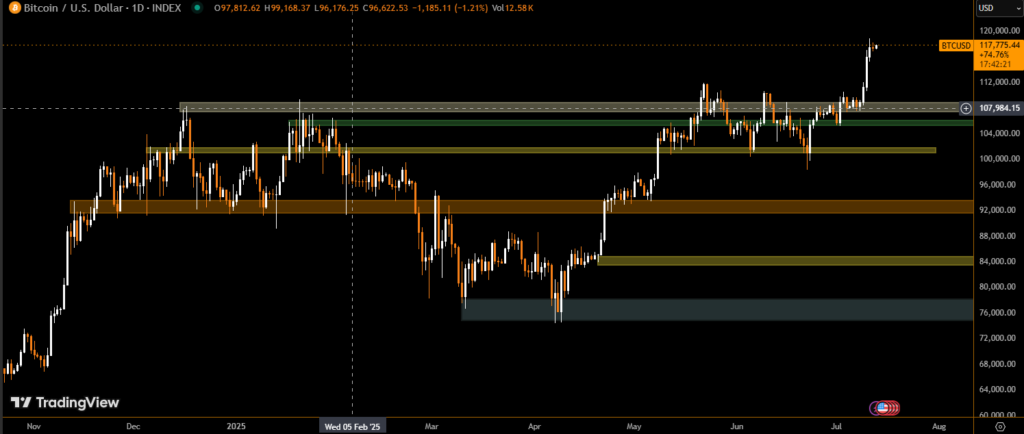

Bitcoin surged past $118,000 this week, setting multiple all-time highs. Despite this, retail investor interest remains surprisingly muted, according to recent market data.

Search interest for “Bitcoin” on Google is down nearly 60% compared to November 2024, when retail engagement spiked following the U.S. presidential election results. This disconnect suggests that institutional investors are currently the primary drivers behind Bitcoin’s latest bull run.

Institutional Demand for Bitcoin ETFs Surges

While public interest has cooled, spot Bitcoin ETFs are seeing record inflows. Over $2.72 billion was invested into spot Bitcoin ETFs during the past five trading days, with more than $1 billion flowing in on both Thursday and Friday—marking the first time this milestone has been hit on consecutive days.

Institutional capital is clearly dominating the market, with ETF demand pushing Bitcoin beyond previous highs.

Retail Hesitancy: “I Missed the Boat”

Many in the crypto community believe retail investors are hesitant due to the current price tag. With Bitcoin above $117,000, the perception is that the opportunity to buy in has passed.

Retail investors may feel priced out, assuming it’s too late to benefit from further upside. Analysts suggest that this sentiment is widespread, leading to the lack of retail participation during what would typically be a high-FOMO period.

Market Analysts Remain Bullish

Despite retail hesitancy, market analysts see continued strength in Bitcoin’s trend. Technical experts note that on-chain indicators remain healthy, and some predict that the current rally still has momentum left.

“This run has plenty of legs left in it,” said one analyst, reflecting a growing view that Bitcoin’s bull cycle is far from over, especially as institutional interest continues to climb.

Conclusion: A Divergence in Behavior

The current rally presents a unique scenario in the crypto market. While Bitcoin breaks records, retail enthusiasm remains absent, and institutions take the lead.

This divergence raises questions about the evolving dynamics of the crypto market and whether traditional indicators of market tops—like retail euphoria—are still valid in an era dominated by ETFs and institutional products.

As Bitcoin approaches new psychological levels, it remains to be seen if and when retail investors will re-enter the market in force.

Disclaimer

This content is for informational purposes only and does not constitute financial, investment, or legal advice. Cryptocurrency trading involves risk and may result in financial loss.